Data-mining expert digs into six popular data-mining lists and offers a few considerations on how to optimize them for success.

By Winston Harrell, Strategic Growth Manager

There is no right way to data mine; the only wrong thing you can do is let all those sales prospects sit untouched in your CRM. Because on any given day, someone in your customer database is thinking about purchasing a new car. The key is not to be afraid to experiment, especially when it comes to the search parameters you use to ID those in-market opportunities.

That holds true when using a data mining tool does the searching automatically. Your store’s average credit score, time of ownership, and annual driving miles can make all the difference. And as we all know, being the first to engage means higher margins. Best of all, you don’t have to pay a lead provider to deliver the business you already earned. Let’s dig into six prospect list you can optimize by simply doing a little homework.

List No. 1: Customers Who Can Lower Their APR While Trading Up

Interest rates are historically low, which means there are opportunities to help past buyers take advantage. Typically, these will be customers with an APR above a certain range. Getting them back into your showroom could mean a new or newer vehicle and potentially saving them thousands of dollars in interest.

Search parameters for this list include average credit score, loan term, and down payment. Specifics vary depending on location. For example, in an area with an average credit score of 650 or less, use 2.5 years or greater as a timeframe of ownership. The reason is that’s the amount of time it takes for consistent payments to improve a credit score.

In fact, it’s a good idea, especially during these uncertain times, to conduct a regular credit bureau analysis. What you need is a credit tier profile of your customers. This knowledge cannot only be used for prospecting, it can guide your inventory sourcing strategy when finance sources tighten up.

List No. 2: Customers Who Can Lower Their Payment While Trading Up

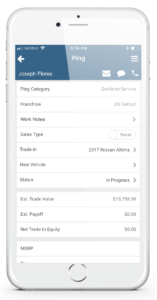

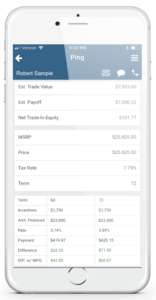

Equity isn’t the only way to help a customer lower their payment while trading out to a new car. Your OEM’s current incentives, as many new car owners discovered through the pandemic in 2020, can also help lower payments. For example, it may be possible to identify car owners who are in a less equitable position but who are eligible for a large rebate, which can help offset their lack of equity.

To identify this list, follow the guidelines of the book your dealership uses to estimate current equity, then adjust according to incentives offered. For example, Kelley Blue Book wholesale plus $500, or NADA average trade-in minus $500.

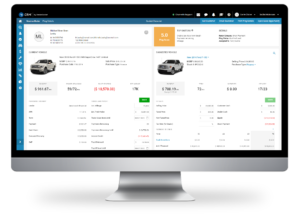

Some data mining solutions will automatically match a prospect’s current vehicle with a vehicle in your inventory that’s similar to the one they already own. That makes it easy to send emails containing your lower payment offer and a link a vehicle details page highlighting the current model-year version of their vehicle.

List No. 3: Customers Who Declined High-Cost Service Repairs

When customers decline recommended services, it might be an indicator that the repair bill was more than the person was willing to invest. That means there’s a good chance they are weighing their options: Pay $3,000 for that repair or just buy a new car? So, set your data mining tool or search for customers who declined repair estimates above $1,500 and $3,000. Success will depend on brand and location, so do some experimenting.

List No. 4: Customers Approaching End of Lease

What makes identifying end-of-lease customers a popular activity is there’s a deadline for them to make a decision and we know the date. So, it’s a far easier process to set up that campaign than one that centers on equity position. The key is to engage these customers six months out and increase the frequency of communications at the deadline approaches.

When building your lists or setting your data mining tool’s parameters, you may want to target a specific model your used car manage wants to add to inventory. You can also search by specific ZIP code, area code, distance to the dealership, or even finance source. Based on the lease criteria, for instance, certain finance sources may come out with lease pull-ahead program that targets Ford F150s.

List No. 5: Customers Approaching End of Finance Term

As customers approach the end of their finance terms, they may be open to considering a new vehicle. Parameters on what the right timeframe is can be a bit tricky. Location and clientele are major considerations. For example, if the majority of your finance deals are for six years, it might be worth contacting some of your customers as soon as three years into the loan.

Customers who drive 12,000-plus miles per year will be open to trading their car at a higher frequency rate than those who drive only 8,000 miles per year. Other parameters to experiment with include equity position and payments.

The key with this list is to find owners who are past the honeymoon phase of ownership. Similar to the seven-year itch in a marriage, there is a period where most car owners don’t hate their vehicles but would be willing to trade up if presented with the option.

List No. 6: Customers in an Equity Position on Their Current Vehicle

If you’ve ever data mined, you are familiar with this list. It doesn’t matter when a customer purchased their vehicle. If they have a certain amount of equity, it can be traded in for a newer vehicle. During periods like the one we’re in today, this list can be especially helpful to your used car manager.

In addition to identifying equity positions, I recommend slanting search parameters toward what the used car manager’s needs are. Specify makes, models, mileage, and other criteria that you want in used inventory. Once you pull these lists from your CRM, enroll prospects into campaigns that utilize email, text, and phone calls from your BDC or sales team.

While not as “hot” as new lead submissions, these lists should yield many potential car buyers. Plus, it’s a great way to check in with your customers. To make the effort worthwhile, ensure that your salespeople or BDC agents know how to qualify prospects. If someone isn’t interested, close them out and move on.

As previously mentioned, there’s no wrong way to mine your customer database, but a little homework and some experimenting will go a long way toward a fruitful data-mining expedition. But you better have a good process that’s written down, implemented, and managed.

# # #