Solera solutions help dealerships out sell, out service, and out perform the competition

Every year, the annual National Automobile Dealers Association (NADA) show attracts thousands of auto dealership employees. They look to network, learn emerging industry trends, and find out about the latest technology that can help them streamline operations and improve improve CX (customer experience).

And we will be there too! We are exhibiting at the Kay Bailey Hutchinson Convention Center from Jan. 26-29th. There we will demonstrate our industry-leading solutions that help dealerships drive sales, reach more customers, and improve profit margins.

Solutions Built for Dealers

Whether it’s marketing and sales, financing and titling, or service and repair, our solutions help:

- Optimize every marketing dollar: Our best-in-class omnichannel marketing platform and CRM help dealers optimize investments across traditional and digital channels. They also support both sales and service business objectives. And new integrations give dealerships additional outbound marketing channels to better reach customers.

- Connect with customers: The DealerSocket CRM is a comprehensive customer management solution that converts and retains customers through the sales and service lifecycle while increasing revenue per transaction. The industry-leading CRM doesn’t only drive sales, but also connects all systems, simplifying and enriching the experience for both your team and customers.

- Maximize customer pay spend: MultiPoint Inspection is your total shop efficiency solution. It enables your team to optimize processes, link workflows across all fixed operations functions, and eliminate wasted time by enabling real-time communications visibility into operations.

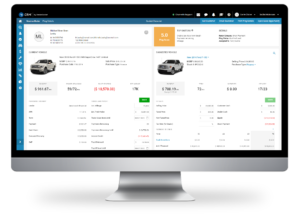

- Stay on top of inventory: Inventory+ keeps inventory fresh by optimizing your vehicle mix, buying and selling vehicles at the right price, and trading with sister stores to stay aligned with sales trends at your dealership. Inventory+ also provides car dealers data based on real-time insights to help them make faster, better decisions.

- Boost profits: The combination of Inventory+ and CRM helps maximize your business outcomes and optimize your processes. You can then better identify efficiencies and manage inventory and incentive investments.

- Elevate dealer websites: Now infused with DealerSocket’s data platform, DealerFire sites delivers fast, sleek websites that are easy to build with no coding required. Powered by Engine6, these websites are fully responsive and are built to perform seamlessly on mobile devices. Thereby, driving more traffic, more leads, and more sales.

Why Meet with Us at NADA 2023

First and foremost, our dealership solutions streamline operations and workflows. But they also provide actionable insights, improve CX, and keep customers engaged with their dealerships. To find out more about how these solutions can accelerate your dealership’s success, visit our NADA page.

When you have access to an all-in-one solution, it minimizes the time and resources needed to get the job done. That’s what dealer management software can do for you. It brings together all functions of inventory management into one simple platform. Why wouldn’t you employ it if it makes your job–and that of your teams–easier?

What Is Dealer Management Software?

Back to the basics: dealer management software is one easy-to-use system with a full suite of products and plugins. It helps integrate and manage sales, parts, service, finance, insurance, and warehouse inventory, creating a more efficient use of resources from staffing to features and services.

How It Benefits Your Dealership Teams

As a saavy DMS user, you likely think you know all the many ways DMS can help, but some may not be readily apparent. Here are nine points to share with your employees and other stakeholders:

- It can identify trends and forecast market needs for parts across organizations or dealer and franchise teams.

- Because it’s cloud-based, it can be accessed and utilized anywhere.

- It also offers savings opportunities because it can lower costs by creating new efficiencies.

- It can identify where available stock or parts are located.

- It helps prevent over-purchasing.

- It helps with local sourcing and needs.

- One of the most efficient uses is offering a full suite of systems that integrates across franchises or dealers.

- Team members can share data and insights.

- And all of this contributes to higher customer satisfaction rates, creating loyal brand advocates.

Why Your Dealership Needs a Powerful DMS

Now that you know the many other ways dealer management software can help, let’s look at why you need it:

- OEMs/Dealers can use the system to forecast needs across systems, offering the opportunity to save money. Since accurate inventory helps to identify needs when discounts are available for stock or parts, dealers can also get refunds on those parts that go unused.

- DMS also centralizes information. It keeps customer data and interactions in one place and helps with local flexibility, locating parts or services across franchises or dealerships.

- It also improves productivity by saving time and sharing accurate data across teams.

- Finally, it gives you access to seamless reporting by offering up-to-the-minute data and insights, which helps with sales growth.

How to Get Started

Dealer management software is the all-in-one solution for your team’s needs, so now is the time to transform. Solera offers enterprise-level solutions, including our innovative DMS and IDMS.

Learn More About Our Best-In-Class DMS & IDMS Solutions

Data-mining expert digs into six popular data-mining lists and offers a few considerations on how to optimize them for success.

By Winston Harrell, Strategic Growth Manager

There is no right way to data mine; the only wrong thing you can do is let all those sales prospects sit untouched in your CRM. Because on any given day, someone in your customer database is thinking about purchasing a new car. The key is not to be afraid to experiment, especially when it comes to the search parameters you use to ID those in-market opportunities.

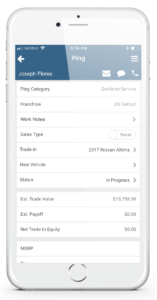

That holds true when using a data mining tool does the searching automatically. Your store’s average credit score, time of ownership, and annual driving miles can make all the difference. And as we all know, being the first to engage means higher margins. Best of all, you don’t have to pay a lead provider to deliver the business you already earned. Let’s dig into six prospect list you can optimize by simply doing a little homework.

List No. 1: Customers Who Can Lower Their APR While Trading Up

Interest rates are historically low, which means there are opportunities to help past buyers take advantage. Typically, these will be customers with an APR above a certain range. Getting them back into your showroom could mean a new or newer vehicle and potentially saving them thousands of dollars in interest.

Search parameters for this list include average credit score, loan term, and down payment. Specifics vary depending on location. For example, in an area with an average credit score of 650 or less, use 2.5 years or greater as a timeframe of ownership. The reason is that’s the amount of time it takes for consistent payments to improve a credit score.

In fact, it’s a good idea, especially during these uncertain times, to conduct a regular credit bureau analysis. What you need is a credit tier profile of your customers. This knowledge cannot only be used for prospecting, it can guide your inventory sourcing strategy when finance sources tighten up.

List No. 2: Customers Who Can Lower Their Payment While Trading Up

Equity isn’t the only way to help a customer lower their payment while trading out to a new car. Your OEM’s current incentives, as many new car owners discovered through the pandemic in 2020, can also help lower payments. For example, it may be possible to identify car owners who are in a less equitable position but who are eligible for a large rebate, which can help offset their lack of equity.

To identify this list, follow the guidelines of the book your dealership uses to estimate current equity, then adjust according to incentives offered. For example, Kelley Blue Book wholesale plus $500, or NADA average trade-in minus $500.

Some data mining solutions will automatically match a prospect’s current vehicle with a vehicle in your inventory that’s similar to the one they already own. That makes it easy to send emails containing your lower payment offer and a link a vehicle details page highlighting the current model-year version of their vehicle.

List No. 3: Customers Who Declined High-Cost Service Repairs

When customers decline recommended services, it might be an indicator that the repair bill was more than the person was willing to invest. That means there’s a good chance they are weighing their options: Pay $3,000 for that repair or just buy a new car? So, set your data mining tool or search for customers who declined repair estimates above $1,500 and $3,000. Success will depend on brand and location, so do some experimenting.

List No. 4: Customers Approaching End of Lease

What makes identifying end-of-lease customers a popular activity is there’s a deadline for them to make a decision and we know the date. So, it’s a far easier process to set up that campaign than one that centers on equity position. The key is to engage these customers six months out and increase the frequency of communications at the deadline approaches.

When building your lists or setting your data mining tool’s parameters, you may want to target a specific model your used car manage wants to add to inventory. You can also search by specific ZIP code, area code, distance to the dealership, or even finance source. Based on the lease criteria, for instance, certain finance sources may come out with lease pull-ahead program that targets Ford F150s.

List No. 5: Customers Approaching End of Finance Term

As customers approach the end of their finance terms, they may be open to considering a new vehicle. Parameters on what the right timeframe is can be a bit tricky. Location and clientele are major considerations. For example, if the majority of your finance deals are for six years, it might be worth contacting some of your customers as soon as three years into the loan.

Customers who drive 12,000-plus miles per year will be open to trading their car at a higher frequency rate than those who drive only 8,000 miles per year. Other parameters to experiment with include equity position and payments.

The key with this list is to find owners who are past the honeymoon phase of ownership. Similar to the seven-year itch in a marriage, there is a period where most car owners don’t hate their vehicles but would be willing to trade up if presented with the option.

List No. 6: Customers in an Equity Position on Their Current Vehicle

If you’ve ever data mined, you are familiar with this list. It doesn’t matter when a customer purchased their vehicle. If they have a certain amount of equity, it can be traded in for a newer vehicle. During periods like the one we’re in today, this list can be especially helpful to your used car manager.

In addition to identifying equity positions, I recommend slanting search parameters toward what the used car manager’s needs are. Specify makes, models, mileage, and other criteria that you want in used inventory. Once you pull these lists from your CRM, enroll prospects into campaigns that utilize email, text, and phone calls from your BDC or sales team.

While not as “hot” as new lead submissions, these lists should yield many potential car buyers. Plus, it’s a great way to check in with your customers. To make the effort worthwhile, ensure that your salespeople or BDC agents know how to qualify prospects. If someone isn’t interested, close them out and move on.

As previously mentioned, there’s no wrong way to mine your customer database, but a little homework and some experimenting will go a long way toward a fruitful data-mining expedition. But you better have a good process that’s written down, implemented, and managed.

# # #

We continue to think about all of you, our customers and partners, during this difficult time. This pandemic has caused deep challenges across our industry and for all of us, and I hope you know that DealerSocket continues to be here for our dealers. Our goal has been to strike the right balance between being prepared for our dealers and the market when our industry recovers and offering discounts to help our dealers as much as possible during this difficult time.

We will get through this, and we will get through this together. We are committed to fighting through this with you. We are beginning to see the first signs of positive trends as we climb out of the depths of the COVID-19 pandemic, and this has us all hopeful for the future.

In April, we heavily discounted our software for our dealers. In addition to our discounts in April, we have decided to offer the following DealerSocket billing reductions for May for all of our dealers:

- 25% off DealerSocket CRM

- 25% off RevenueRadar, our data and equity mining tool (see note below)

- 50% off Car Wars

- 25% off Inventory+

- 25% off DealerFire websites and PrecisePrice digital retail (see note below)

- 15% off IDMS

- 15% off Auto/Mate DMS

We have already sent out our May invoices, so next week you will receive a credit memo for the above discounts. With that said, similar to our discount package last month, there are some basic qualifying terms listed below.

In addition to these discounts in April and May, DealerSocket continues to offer our customers several promotions and free months of certain software products to help you navigate this crisis. Our offers include promotions for:

- Precise Price digital retailing

- Inventory+ Absolute Sourcing and New Car functionality

- Delivery Test Drive Scheduler

- Digital Credit Application

- Auto/Mate Remote eDeal

Since we are adding promotions and various resources for dealers often, please view DealerSocket’s latest information by clicking here, and, as always, please feel free to reach out to your Customer Success Manager with any questions or if we can help in any way:

If you are not yet an Auto/Mate DMS customer, I hope you know that we can reduce your DMS bill significantly during these challenging times as well as into the future by switching to Auto/Mate DMS. We have several bundled packages that include our Auto/Mate DMS product combined with other DealerSocket products to support you.

Thank you for partnering with DealerSocket. I hope you know how much we value and appreciate your loyalty, partnership, and your business.

I wish you, your families, and your team members health in these unprecedented times.

Sejal Pietrzak

CEO and President

DealerSocket

[email protected]

Details regarding our COVID-19 relief package:

- The fee reductions above represent discounts to the monthly subscription amounts by DealerSocket and not third-party products and fees such as DMS integration fees, books fees, and other transactional fees.The discounts above apply to customers that are current with their DealerSocket account.

- Note: OEM programs for websites, equity mining, and digital retailing offerings will be subject to working through OEM partners.

With threat actors working overtime, DealerSocket’s head of information security offers three tips to keep your dealership’s and your customers’ data protected.

By Gregory Arroyo

Greg Tatum has a warning for dealerships everywhere: Cyber threat actors are working overtime. Noting a definite uptick in suspicious activity since COVID-19 hit Europe in late February, he adds:

“Threat actors are actively searching for new targets through a number of different mediums. Things like social media platforms are a very popular target for information gathering that can be used in an attack.”

Tatum serves as DealerSocket’s head of information security. He joined DealerSocket nearly four years ago from a security services firm that works with companies in much more sensitive environments than automotive. I’m talking about healthcare and government contractors, sectors that see billions of attacks each year. So, yeah, we have the right guy on the job.

“DealerSocket spends a considerable amount of effort protecting our customers’ data,” he notes. “It’s part of what we do just to make sure our customers’ customers’ data is protected.”

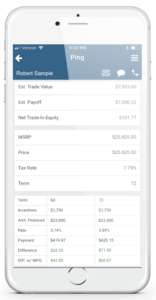

Tatum isn’t the only one sounding the alarm. The FBI issued its own warning on March 20, noting that scammers are leveraging the COVID-19 pandemic to steal money, personal information, or both.

Just last week, the National Automobile Dealers Association reported that attackers are now putting up COVID-19-related websites that prompt visitors to download an application to receive COVID-19 updates. But you don’t need to download the app, as the site installs a malicious binary file as you contemplate whether you should.

The attack method uses AZORult, software that originated in Russia approximately four years ago to steal data and infect the breached computer with malware.

Tatum also alerted me to a new phishing campaign that pretends to be from a local hospital notifying recipients that they have been exposed to the Coronavirus and they need to be tested.

But it’s not just phishing and ransomware attacks. Business email compromise, or BEC, is also on the rise. That’s when a cyberthief breaks into a legitimate corporate email account and impersonates an employee to get the business, its partners, or other employees to send money or sensitive data to the attacker.

“In this climate we live in today, this is part of business,” Tatum says. “This is part of what we have to deal with as consumers of technology.”

Tatum, by the way, is available to help. He advises DealerSocket customers to contact their Customer Success Managers to get connected. In the meantime, he offers the following four tips to safeguard your organization and your customers’ data:

1. Stay Committed to General Security Awareness

The following is general security etiquette your teams should employ:

- Use strong, unique passwords for every account.

- Update software and enable automatic updates where available

- Think before you click

- Remain skeptical of all requests for sensitive information

- Use a VPN connection whenever possible to ensure secure data transmissions

- Shred or destroy confidential documents before discarding

2. Separate Work and Personal Data

Use company-issued computers and mobile devices for work purposes only. If you don’t have a company-issued device, be sure to check your company’s policies about using personal devices to access your organization’s data or networks.

Additionally, consider creating separate user accounts. Never use your work email for personal reasons or vice-versa. This segregation helps the company maintain the confidentiality of the data it collects and helps you maintain your privacy.

3. Secure Your Home Network

Update your router’s username and password immediately and use a strong, unique password. And never use the same password for your network and your router. Note that most routers ship with default login credentials that are public knowledge.

4. Don’t Forget About Physical Security

The comfort of your own home is no reason to forget about physical security. Simple acts like keeping doors locked and not leaving mobile devices unattended in a vehicle are non-technical ways to improve security.

Gregory Arroyo is the former editor of “F&I and Showroom” and “Auto Dealer Today” magazines. He now serves as senior manager of strategic content for DealerSocket. Email him at [email protected].

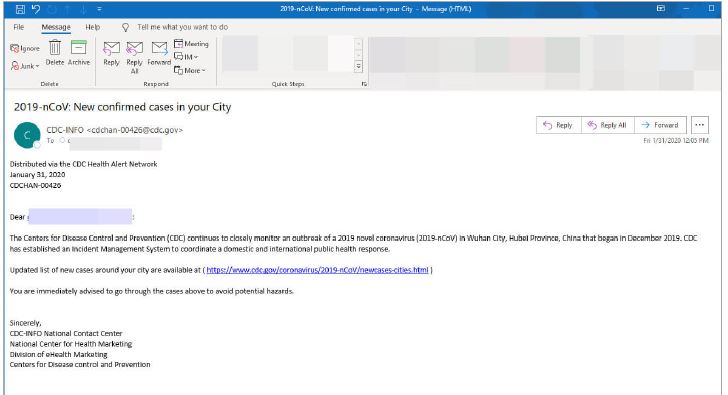

The Kansas City dealer group is hoping the digital steps it’s taken through the years will sustain demand through the COVID-19 pandemic.

By Gregory Arroyo

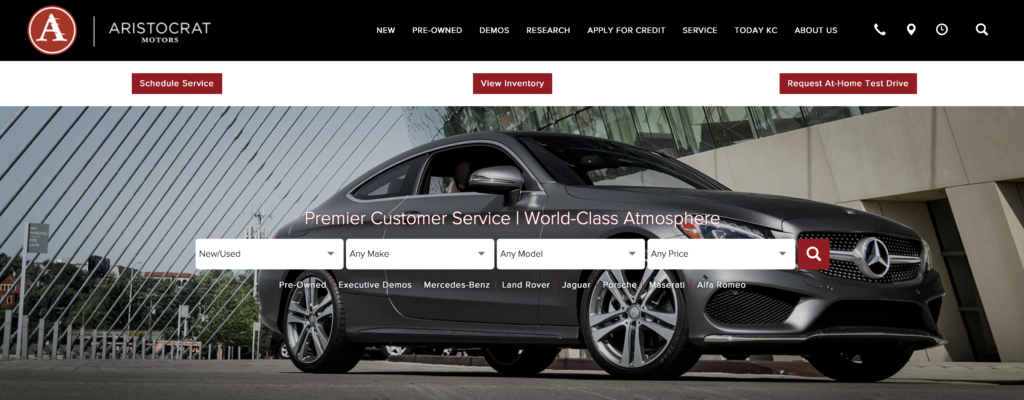

Pictured is the showroom of Soave Automotive Group’s Mercedes-Benz of Kansas City, Mo.

Soave Automotive Group, a multi-rooftop operation serving the greater Kansas City area, was off to a solid year, with sales and service profitability outpacing 2019 through February and no sign of that momentum wavering. That was before local health officials delivered two COVID-19-related orders within a period of six days.

The first, which ordered the closure of all social venues like bars and restaurants on March 17, left Kristopher Nielsen unfazed. As Soave’s eCommerce and customer experience manager, he was on the line that day with DealerFire’s design team to get the group’s response to the Coronavirus pandemic online and out to its markets.

“We have no plans to scale back our ad budget,” Nielsen said. “We’re not going to have a knee-jerk reaction. I think there are real opportunities to gain market share in this difficult situation.”

Ready for Anything

The forward-thinking steps the group has taken over the years to button up its operations and virtual presence was the reason for Nielsen’s optimism. He felt especially positive about the integration between the group’s DealerFire websites and DealerSocket’s CRM.

The connection allows him to see how many website visitors a campaign generates, which vehicles they look at, time on site, and then alerts his teams when those customers return — critical capabilities in the weeks ahead.

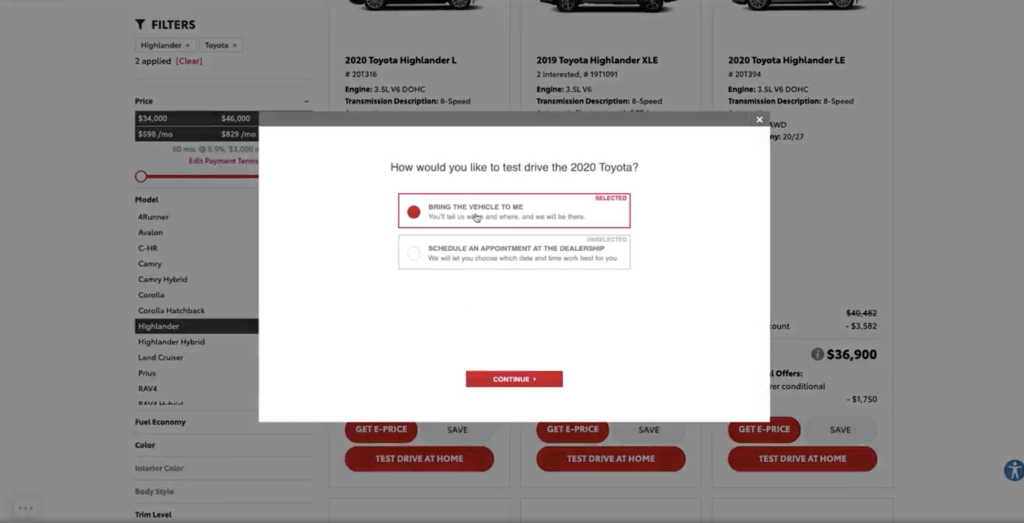

Nielsen also feels good about the group’s online service scheduling and fully online purchase process, which had generated robust engagement in the 90 days prior to his call with DealerFire. The newest addition to Soave’s websites is DealerFire’s test-drive delivery scheduler, which Nielsen added as part of the provider’s 100-day free use offer.

All three shopper experiences would get calls to action on the landing pages he wanted DealerFire to build to house the group’s COVID-19 response. The main message was that Soave Automotive’s dealerships were open and ready to help.

Promoting those landing pages would be an email campaign, press release, announcement bars on the group’s homepages, and the same SEO content strategy Soave had perfected since partnering with DealerFire in 2010. “The biggest thing for us is checking in on customers and orders coming in,” Nielsen said. “We’re contacting customers reaching the end of their leases. They’re going to need a car regardless of what’s going on in the world.”

Stay the Course

Soave was closing out a lighter than usual but still productive weekend when the second health order was issued. This time, all non-essential businesses were ordered to close on March 24 to stem the spread of the virus, which has infected more than 700 people in the Kansas City area. Dealership service departments could remain open, but sales were limited to appointment-only.

Nielsen said the shoppers who visited his group’s showroom that weekend were especially motivated to buy. Online traffic remained relatively stable, but lead and contact volume declined. Service capacity also declined, as customers opted against non-critical repairs.

Pictured is one of the COVID-19 landing pages DealerFire created for Soave Automotive.

“We’re actually still on track with last year, but January and February were very strong,” Nielsen said. “We’re now going to give back some of those gains.”

As for inventory, Nielsen said the group is keeping in touch with manufacturers as production shuts down. The group wasn’t concerned about being oversupplied, Nielsen noting that Soave has enough vehicles on the ground to get through April.

“A rising tide lifts all boats. Only when the tide goes out do you discover who’s been swimming naked,” Nielsen said. “We recognize that all we can control is how we react. So we’re trying to stay positive and plan as best as we can for where things may go.”

DealerSocket’s First Pencil blog offers a peek into discussions taking place in dealer showrooms everywhere. At-home test drives are top of mind, as is digital retailing.

By Gregory Arroyo

It hit me like a ton of bricks. I drove to my son’s school this morning to pick up his tablet for virtual learning. I was excited to get out of the house, but the reality of today’s situation hit me when I saw masked and gloved teachers approach my vehicle to hand me his tablet.

Great leaders always seem to rise to the occasion, and those teachers were doing just that.

I’ve also witnessed great leaders emerging in dealer showrooms. We’ll be featuring them in our new “Inside the Dealership” series, but I’d like to share some tidbits from those interviews as well as notes I’ve jotted down from the social media groups to which I belong.

No Plans to Scale Back

You got to love car people. No matter the situation, you’ll never hear fear in their voice. I say that after listening in to a call between DealerFire’s design and content team and Kristopher Nielsen, who serves as eCommerce and guest experience manager for Kansas City’s Aristocrat Motors.

“We have no plans to scale back our ad budget,” he said firmly. “A rising tide lifts all boats. Only when the tide goes out do you discover who’s been swimming naked.

“We’re not going to have any knee-jerk reactions,” he continued, “because I think there are real opportunities to gain market share in a difficult situation.”

What he was referring to is the shopper conveniences his group offers, including the group’s fully online purchase process, online service scheduling, and at-home test-drives. All three of those offerings got calls to action in the group’s email, landing page, and other marketing pieces detailing the operation’s response to the coronavirus pandemic.

Top-Down Leadership

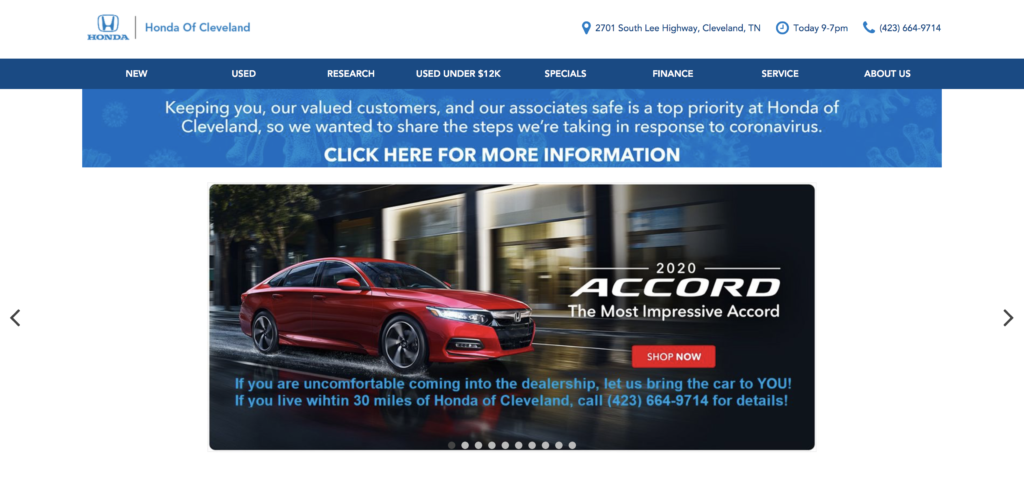

Then there’s Honda of Cleveland, Tenn., which had an action plan in place the day before Tennessee Gov. Brad Lee declared a state of emergency. That plan was delivered by Brad Cobb, president of Bowers Automotive and owner of Honda of Cleveland. He first shared it with the dealership’s general manager, who shared it with his managers, who shared it with their teams.

“The key has been the communication from the top,” Hailey says. “We’re respecting what’s going on, but we’re not fearing it. We just want to keep things positive.”

Mixed Reports

Overall, it seems at-home test-drives are top of mind, at least on social media. While I try not to plug my company’s products, I feel compelled to share that DealerFire will offer free use of its test-driver delivery scheduler for 100 days to owners of a DealerFire website who also use DealerSocket’s CRM. Click here for details.

News regarding showroom traffic seemed mixed. Some car people reported a business-as-usual sales weekend, while others reported cancellations and empty showrooms. Things seemed to turn a bit as the week progressed, as I began seeing posts about dealers adjusting employee schedules. One post indicated that the dealer was letting employees walk with the promise that the dealership would hire them back once the crisis subsides.

It’s only been Week One of this social distancing, and I can’t fathom what’s to come. My heart and thoughts go out to my commission-based friends manning showrooms and F&I offices. Hey, we got this.

As my friend “Mad” Marv Eleazer likes to say, good luck and keep closing.

Gregory Arroyo is the former editor of “F&I and Showroom” and “Auto Dealer Today” magazines. He now serves as senior manager of strategic content for DealerSocket. Email him at [email protected].

The business has navigated unprecedented hardships before, and DealerSocket’s First Pencil blog believes there’s no reason it won’t do it again.

By Gregory Arroyo

Remember the period between late 2007 and 2009, when the housing crash that caused the credit crisis led to the Great Recession? The market was tough to read, and the used-car guides were all over the map.

Dealers that bulked up on big trucks and SUVs were stuck with a lot full of them, as gas prices reached $4 a gallon and finance sources tightened up. Any car buyer with below-prime credit couldn’t get approved, as banks weren’t sure where car buyers — particularly those with investment properties — would land and finance companies were dead in the water.

The good news right now is we’re not experiencing any of those market dynamics. But news surrounding COVID-19 (a.k.a. the Coronavirus) has certainly heated up in recent days.

Hearing about Tom Hanks was disconcerting. So was hearing about the National Basketball Association’s decision to suspend the season, after Utah Jazz center Rudy Gobert became the first major professional athlete to test positive for the virus. Now his teammate, star Donovan Mitchell, has tested positive.

As of March 10, there have been at least 116,000 coronavirus cases worldwide. About 64,000 people have recovered, and 4,000 have died. Here in the United States, multiple states are under a state of emergency.

With all that said, the one thing I love about this business is how opposed it is to doom-and-gloom talk. In fact, just yesterday, the founder of a car dealer Facebook group I belong to urged all admins not to allow panic to take over the group.

“I don’t want negative talk about this affecting us,” he wrote.

It made me think of this great line from the first Avengers movie: “Until such time as the world ends, we will act as though it intends to spin on.”

Hey, consumers who need a new car (or used) today will still need it tomorrow. Still, it’s not business as usual, so preparation is vital.

So, if you’ve loaded up with inventory the past couple of months to take advantage of tax season, monitoring aging will be key. And if you’re part of a group that engages in group trading, it’s time to dig into your inventory management systems to ensure vehicles are on the right lots. It’s not time to panic, but you should have exit plans in place.

I recall a story told to me back in 2009. A dealer in the Northeast took on a bulk of pickups in trades just before things got bad. Having dumped $5,000 to $7,000 into the vehicles, he refused to take a loss at auction when things did — even though he was losing money each day those vehicles sat on his lot. His patience was rewarded, however, as he ended up grossing $2,000 to $5,000 by waiting out the storm for a couple of months. Americans do love their trucks and SUVs.

You also need to fire up that CRM. Hey, you know you have customers reaching the end of their finance, lease, or warranty term. Vehicles also need to be serviced. Maybe it’s an excellent time to offer free service pickup and return.

And if you’re a dealer that dipped your toe in the digital retail waters — or maybe offer test-drive deliveries — today’s uncertainty represents an opportunity to really test those strategies.

So, start promoting those customer conveniences, and make sure your digital retail button stands out. In other words, remove any conflicting calls to action on your vehicle details and dedicated landing pages. Banner promotions on your search results pages and VDPs are a must.

Now, when it comes to your employees, I suggest not sticking your head in the sand. Management teams need to get educated on this virus, and communication will be critical. Care also needs to be taken when it comes to the cleanliness of your showroom, employee offices, and common areas.

With all that said, here’s what I do know in all this uncertainty: Every time this business faces a severe hardship, it always seems to come out the other side a better industry. I’m sure that will be the case once again.

Gregory Arroyo is the former editor of “F&I and Showroom” and “Auto Dealer Today” magazines. He now serves as senior manager of strategic content for DealerSocket. Email him at [email protected].