A secure and seamless flow of credit information from online application through to the CRM, onto lending portals, then back again.

Compliant

Fast

Manage credit, finance, and compliance further upstream in the sales process with automated, digitized processes.

Integrated

Save on processing time with application details and streamlined bank approvals displaying within the DealerSocket CRM.

Easily Submit Applicants to Lending Institutions of Choice

Credit approvals are easy with push-button integrations that seamlessly pass data to lending portals like RouteOne or DealerTrack and on to the DMS with one click.

Credit Decisions and Reports Display in Real-Time

Get credit decisions, reports, and new credit application completion details within the CRM – they'll display automatically with notifications to alert you.

End-to-End Dealership Credit Process Management

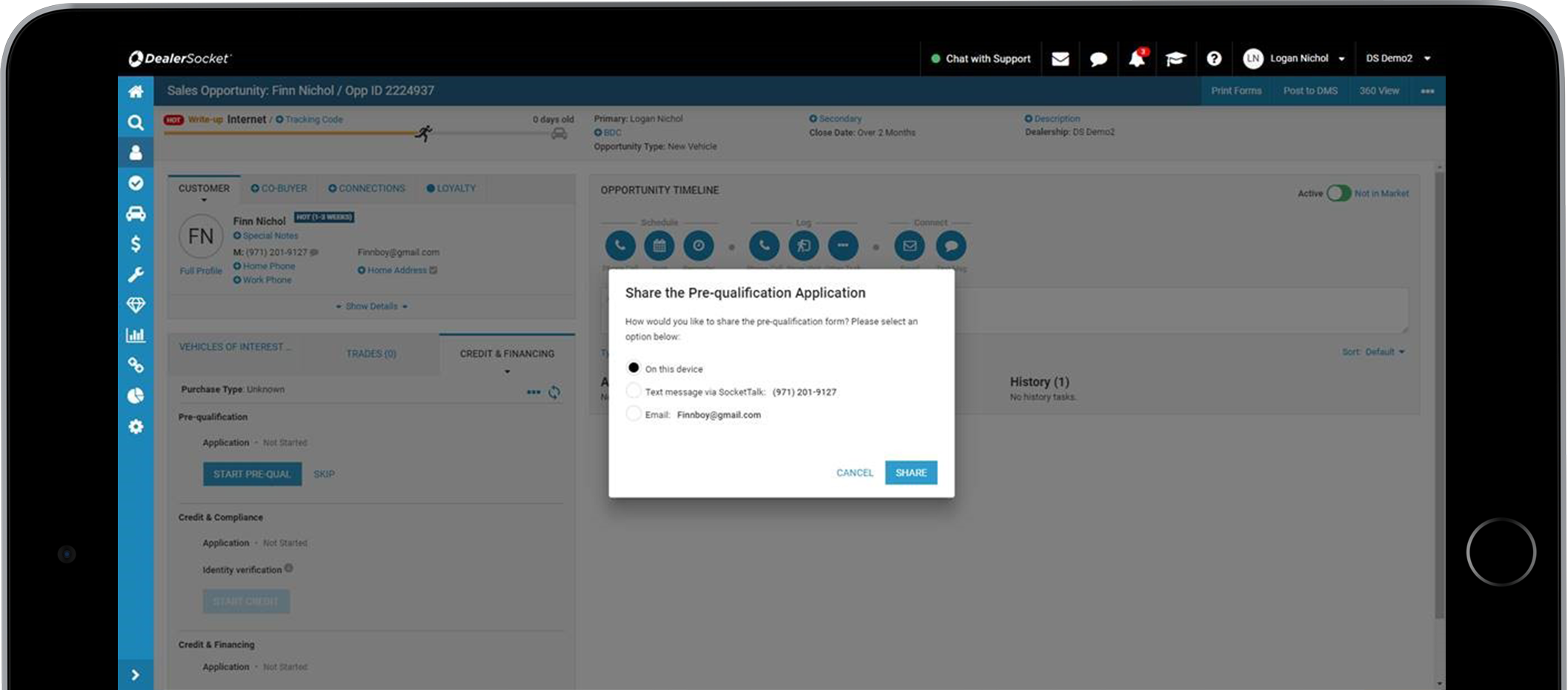

Prequalify Customers Early in the Sales Process with Soft Credit Pulls

Accelerate the sales process with soft credit checks. Get the validation you need to ensure you’re presenting an accurate, approval-ready deal structure without impacting the consumer’s credit score.

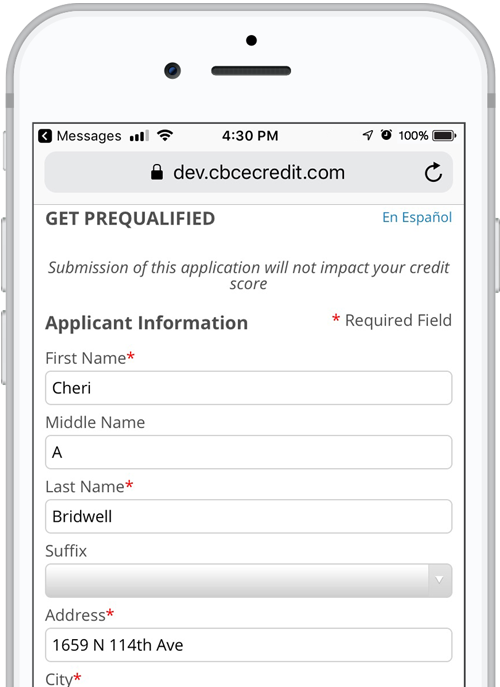

Expand the Car Buying Process with Digital Consumer Credit Applications

Add a secure credit application to your website or send it via a mobile-friendly text or email link. Each data point within the application is securely pushed line-for-line back to the DealerSocket CRM, reducing the need for duplicate data entry.

Everything is Easier Using DealerSocket CRM

Manage the entire credit process from your DealerSocket CRM Credit & Financing tab. With integrated customer relationship management and crediting features, you can easily collect customer information, automate prequalification using custom business rules, increase customer trades with an easy-view of loan and lease details, and follow applications through the approval process.

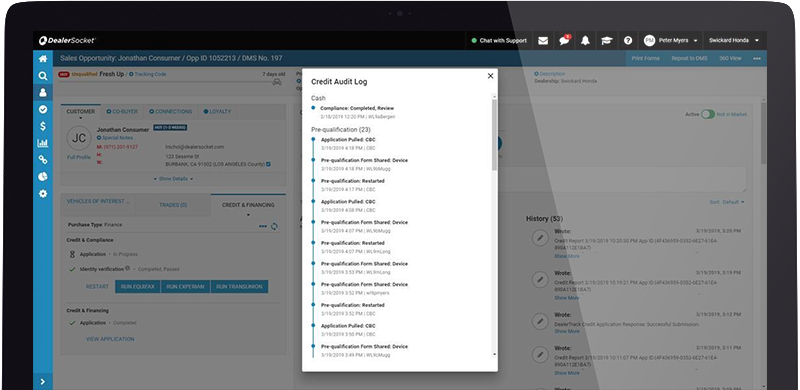

Manage Necessary Compliancy with Built-In Checks and Balances

Ensure you've gathered consent, presented the proper disclosures, and run required identity verifications. A digital audit log of credit processing times, dates, and associated users is easily-accessible from a centralized compliance portal.

Want to know more?

Click to set up a demo now with a representative and learn more about DealerSocket CRM.