Over the Curb: Car Buyer Loyalty Reaches Tipping Point

November 21, 2019

An interesting observation causes a general manager for a Toyota store to wonder if the industry has reached a tipping point in today’s Digital Age.

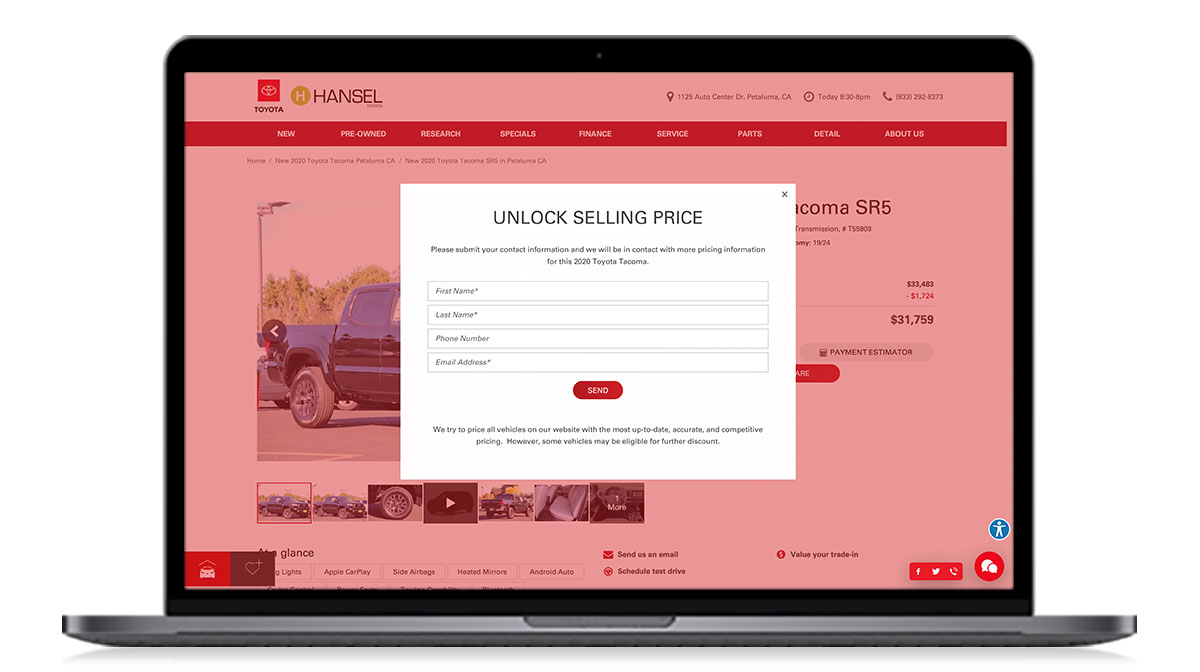

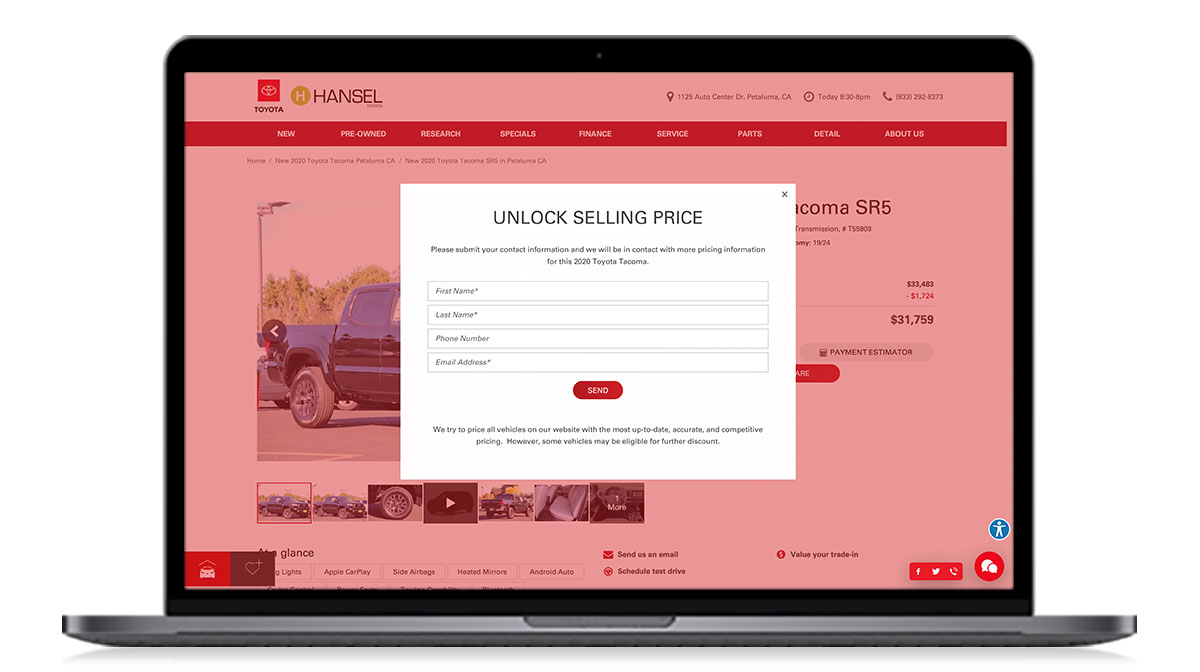

A general manager (GM) for a Toyota store in Arkansas made a stunning observation: A “super-loyal” customer who has purchased five cars from the same salesperson, who he loves and “won’t buy from anyone else,” came in as an internet lead.

Yup, instead of calling his beloved Jackie to say he’s coming in to look at a new Toyota Tacoma, Mr. Super-Loyal visited the dealership’s website, found the vehicle he wanted, and submitted a lead form. The horror, right? Well, it wasn’t the first time the GM observed such a thing.

“He was an internet sale, so the website got credit for that sale,” the GM told me. “It wasn’t a conquest sale. We didn’t go out and get us a new customer, but, technically, on paper, it’s an internet sale.”

Remember when market studies told us car buyers were shopping less than two dealerships before pulling the trigger. Well, according to a poll of 2,001 consumers conducted by The Harris Poll on behalf of Urban Science, consumers are visiting, on average, 2.5 dealerships. Wait, it gets better.

Generation Z and young millennials — you know, the ones who were supposed to skip the showroom experience altogether — are visiting, on average, 3.5 dealerships. Gen X visits 2.3 dealerships, while older millennials and Boomers visit, on average, two.

Randy Berlin, global director of dealer consulting for Urban Science, says the reason visits are higher among the younger demographics is “they have no brand identity or loyalty.”

“The young people, they’re just not brand loyal at all, except for maybe Apple,” he adds.

And get this: Berlin says the average customer is submitting an average of three leads. The reason, he says, is customers are cross-checking prices. See, price (84%) is the most significant influencer of a buying decision — even above a “low-pressure sales approach (72%).”

The GM’s story and all this new data makes me wonder why data mining isn’t getting more hype, especially when we’re dealing with a less loyal customer who is focused on price and is cross-checking two to 3.5 dealerships.

All of this reminds me of something I heard from one of our Strategic Growth Managers for our RevenueRadar tool. His name is Winston Harrell, a 33-year industry veteran and a serious data-mining pro. To demonstrate the power of the tool to new clients, he asks them to load the solution with the conditions that point to a high-target prospect or are important to the dealership. Then he has them run a report to see how many people the dealership sold a car to in the last month fit those parameters.

“It’s pure amazement,” he says. “Unfortunately, no one reached out to those customers, so they showed up as a fresh up or an internet lead.”

And you know your third-party lead providers are more than happy to take credit for those sales.

Harrell says the reason most dealers lose faith in data mining is they don’t have a defined process that’s written down, implemented, and managed by a dedicated person. Think BDC manager.

DealerSocket commissioned its own study. Conducted by Strategy Analytics, nearly 50% of the 500 dealers polled listed “Identifying the best places to invest marketing spend” as their No. 1 pain point. Again, I’m not sure why data mining isn’t getting more hype when it’s clear the answer is buried in the data.

Remember when market studies told us car buyers were shopping less than two dealerships before pulling the trigger. Well, according to a poll of 2,001 consumers conducted by The Harris Poll on behalf of Urban Science, consumers are visiting, on average, 2.5 dealerships. Wait, it gets better.

Generation Z and young millennials — you know, the ones who were supposed to skip the showroom experience altogether — are visiting, on average, 3.5 dealerships. Gen X visits 2.3 dealerships, while older millennials and Boomers visit, on average, two.

Randy Berlin, global director of dealer consulting for Urban Science, says the reason visits are higher among the younger demographics is “they have no brand identity or loyalty.”

“The young people, they’re just not brand loyal at all, except for maybe Apple,” he adds.

And get this: Berlin says the average customer is submitting an average of three leads. The reason, he says, is customers are cross-checking prices. See, price (84%) is the most significant influencer of a buying decision — even above a “low-pressure sales approach (72%).”

The GM’s story and all this new data makes me wonder why data mining isn’t getting more hype, especially when we’re dealing with a less loyal customer who is focused on price and is cross-checking two to 3.5 dealerships.

All of this reminds me of something I heard from one of our Strategic Growth Managers for our RevenueRadar tool. His name is Winston Harrell, a 33-year industry veteran and a serious data-mining pro. To demonstrate the power of the tool to new clients, he asks them to load the solution with the conditions that point to a high-target prospect or are important to the dealership. Then he has them run a report to see how many people the dealership sold a car to in the last month fit those parameters.

“It’s pure amazement,” he says. “Unfortunately, no one reached out to those customers, so they showed up as a fresh up or an internet lead.”

And you know your third-party lead providers are more than happy to take credit for those sales.

Harrell says the reason most dealers lose faith in data mining is they don’t have a defined process that’s written down, implemented, and managed by a dedicated person. Think BDC manager.

DealerSocket commissioned its own study. Conducted by Strategy Analytics, nearly 50% of the 500 dealers polled listed “Identifying the best places to invest marketing spend” as their No. 1 pain point. Again, I’m not sure why data mining isn’t getting more hype when it’s clear the answer is buried in the data.

Remember when market studies told us car buyers were shopping less than two dealerships before pulling the trigger. Well, according to a poll of 2,001 consumers conducted by The Harris Poll on behalf of Urban Science, consumers are visiting, on average, 2.5 dealerships. Wait, it gets better.

Generation Z and young millennials — you know, the ones who were supposed to skip the showroom experience altogether — are visiting, on average, 3.5 dealerships. Gen X visits 2.3 dealerships, while older millennials and Boomers visit, on average, two.

Randy Berlin, global director of dealer consulting for Urban Science, says the reason visits are higher among the younger demographics is “they have no brand identity or loyalty.”

“The young people, they’re just not brand loyal at all, except for maybe Apple,” he adds.

And get this: Berlin says the average customer is submitting an average of three leads. The reason, he says, is customers are cross-checking prices. See, price (84%) is the most significant influencer of a buying decision — even above a “low-pressure sales approach (72%).”

The GM’s story and all this new data makes me wonder why data mining isn’t getting more hype, especially when we’re dealing with a less loyal customer who is focused on price and is cross-checking two to 3.5 dealerships.

All of this reminds me of something I heard from one of our Strategic Growth Managers for our RevenueRadar tool. His name is Winston Harrell, a 33-year industry veteran and a serious data-mining pro. To demonstrate the power of the tool to new clients, he asks them to load the solution with the conditions that point to a high-target prospect or are important to the dealership. Then he has them run a report to see how many people the dealership sold a car to in the last month fit those parameters.

“It’s pure amazement,” he says. “Unfortunately, no one reached out to those customers, so they showed up as a fresh up or an internet lead.”

And you know your third-party lead providers are more than happy to take credit for those sales.

Harrell says the reason most dealers lose faith in data mining is they don’t have a defined process that’s written down, implemented, and managed by a dedicated person. Think BDC manager.

DealerSocket commissioned its own study. Conducted by Strategy Analytics, nearly 50% of the 500 dealers polled listed “Identifying the best places to invest marketing spend” as their No. 1 pain point. Again, I’m not sure why data mining isn’t getting more hype when it’s clear the answer is buried in the data.

Remember when market studies told us car buyers were shopping less than two dealerships before pulling the trigger. Well, according to a poll of 2,001 consumers conducted by The Harris Poll on behalf of Urban Science, consumers are visiting, on average, 2.5 dealerships. Wait, it gets better.

Generation Z and young millennials — you know, the ones who were supposed to skip the showroom experience altogether — are visiting, on average, 3.5 dealerships. Gen X visits 2.3 dealerships, while older millennials and Boomers visit, on average, two.

Randy Berlin, global director of dealer consulting for Urban Science, says the reason visits are higher among the younger demographics is “they have no brand identity or loyalty.”

“The young people, they’re just not brand loyal at all, except for maybe Apple,” he adds.

And get this: Berlin says the average customer is submitting an average of three leads. The reason, he says, is customers are cross-checking prices. See, price (84%) is the most significant influencer of a buying decision — even above a “low-pressure sales approach (72%).”

The GM’s story and all this new data makes me wonder why data mining isn’t getting more hype, especially when we’re dealing with a less loyal customer who is focused on price and is cross-checking two to 3.5 dealerships.

All of this reminds me of something I heard from one of our Strategic Growth Managers for our RevenueRadar tool. His name is Winston Harrell, a 33-year industry veteran and a serious data-mining pro. To demonstrate the power of the tool to new clients, he asks them to load the solution with the conditions that point to a high-target prospect or are important to the dealership. Then he has them run a report to see how many people the dealership sold a car to in the last month fit those parameters.

“It’s pure amazement,” he says. “Unfortunately, no one reached out to those customers, so they showed up as a fresh up or an internet lead.”

And you know your third-party lead providers are more than happy to take credit for those sales.

Harrell says the reason most dealers lose faith in data mining is they don’t have a defined process that’s written down, implemented, and managed by a dedicated person. Think BDC manager.

DealerSocket commissioned its own study. Conducted by Strategy Analytics, nearly 50% of the 500 dealers polled listed “Identifying the best places to invest marketing spend” as their No. 1 pain point. Again, I’m not sure why data mining isn’t getting more hype when it’s clear the answer is buried in the data.

Want to try DealerSocket?

Fill out the form below to schedule a demo now.