Data from DealerSocket’s Inventory+TM team reveals profitable opportunities for dealers who stayed the course.

Field reports in May confirm what DealerSocket’s April snapshot of appraisal trends seemed to indicate — that a high degree of pent-up consumer demand could create a small window of opportunity for dealers to generate higher gross profits on the sale of used inventory.

May Appraisal Trends

Retail Demand Resets Market

Purchase appraisals, or wholesale/auction vehicles evaluated by dealers, fell to their lowest level the week of April 6. Since then, appraisal counts for this category have increased by 114.7%. In May alone, purchase appraisals rose 135%.

The pick-up in activity reveals that retail demand is once again setting the market, with the guidebooks in catch-up mode due to auction closures in March and Apil and dealers on the hunt for pre-owned vehicles core to their dealership and available at the right wholesale price.

of their core inventory,” Black Book stated in a recent report, adding that dealers are hesitant to get stuck with vehicles they don’t traditionally stock in a depreciating market.

Data from DealerSocket’s Inventory+ team shows a 20% week- over-week decline in total appraisals the week of March 16, when most stay-at-home orders took effect. Trade appraisals, or appraisals that occur on a customer’s trade-in, were down 26% during the same period, while “Purchase Appraisals” on wholesale and auction units plunged by 35%, according to the data.

Data from DealerSocket’s Inventory+ team shows a 20% week- over-week decline in total appraisals the week of March 16, when most stay-at-home orders took effect. Trade appraisals, or appraisals that occur on a customer’s trade-in, were down 26% during the same period, while “Purchase Appraisals” on wholesale and auction units plunged by 35%, according to the data.

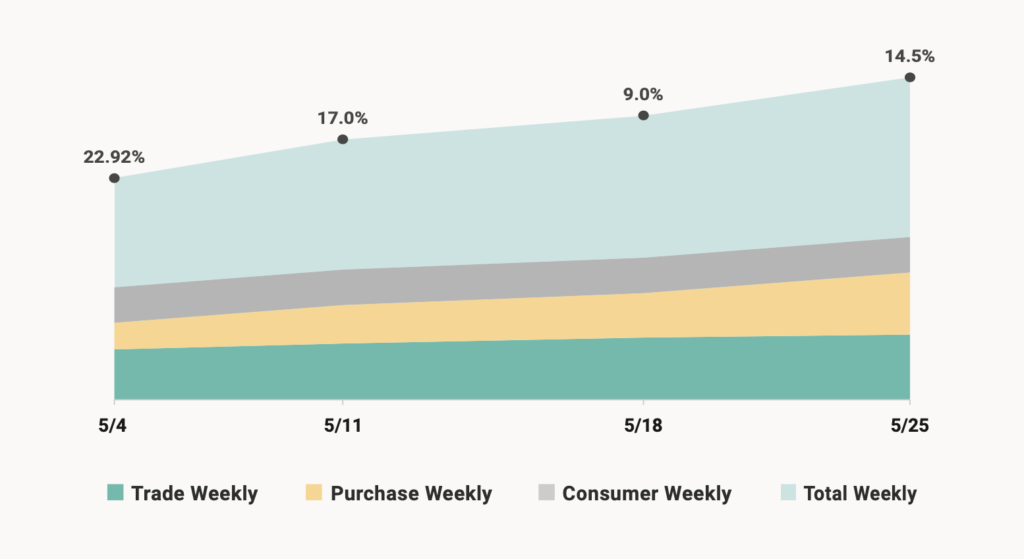

Overall, appraisals were down 34.4% from the first week of March to the first week of April. However, activity has trended up since.

Window of Opportunity

Inventory+ users in the Northeast, where some markets remain limited to appointment-only sales as of early June, are reporting either record-setting months for April and May or year-over-year increases in terms of pre-owned sales counts and gross profits. And that momentum seems to be carrying over into June.

Trade appraisal counts appear to confirm strong consumer demand, with the number of trade appraisals (evaluation of consumer trade-ins at the dealership) increasing 27.8% in May after bottoming out in early April due to the impact of shelter-in-place orders. Since April 6, trade appraisals have risen 97.9%.

Consumer appraisal counts offer an even brighter outlook, as consumers continued to initiate vehicle evaluations through online lead forms during the height of shelter-in-place orders.

The apparent retail demand is now rewarding dealers who resisted the urge to offload aging units, as inventory shortages are allowing them to get higher asking prices with little to no negotiation. Some dealers, according to field reports, are even pricing units they’ve had since March like it was Day 1 on the lot.

The going theory is consumers camped out on vehicles of interest through the COVID-19 period between March and April, hoping for a price cut that never materialized.

Conclusion

As the old saying goes, make hay while the sun shines, and the sun is still shining in terms of a dealer’s opportunity to generate higher front-end gross profit. However, that window of opportunity won’t stay open for long, with wholesale value normalization expected in the next three to four weeks. The guidebooks, by some estimates, are about a month to a month and a half behind.

For now, dealers need to hit the reset button on their aging strategies and pump up retail prices, especially on three-, four-, and five-year-old vehicles. The exception is late-model units, which should be priced and advertised around factory new-vehicle incentives. Lease returns and the expected flood of rental units should refuel inventory levels, but not until the wholesale prices for those market-returning units fall to a more reasonable level.