Set to Scale: Building the foundations for growth

If you run a dealership, your teams can spend ample time transferring data between systems, sometimes entering the same data multiple times. In general, dealership management systems (DMS) are designed as a point of origin, meaning they are primarily constructed to push data out and not take data in. They were designed this way for a good reason. Protecting access to the DMS secures the sensitive financial information stored within.

However, this architecture also means that dealership employees may spend significant amounts of time entering the same data into more than one system. From the time a vehicle is acquired until it is sold and booked, multiple employees log in and out of the customer relationship management (CRM) system, inventory tool, and DMS, often for overlapping purposes. A manual data entry process adds time to the sales process and increases error risks each step of the way. A single mistake, such as transposed VIN digits incorrectly entered into a DMS, can lead to multiple errors in other systems. Simply correcting the error in the DMS often doesn’t resolve the errors in the other systems, and that’s if a dealer even realizes where the initial inaccuracy occurred. This can lead to valuable time spent on the phone with customer support to identify the error source and the required fix in each system.

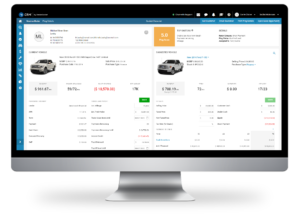

Dealers can address these inefficiencies with a unified platform from DealerSocket that integrates and connects your dealership’s DMS, inventory tool, and CRM in near real-time. These integrations enable an instant data exchange from system to system, rather than pushing data in large batches from one system to another.

Read on for several key examples of how your teams can streamline processes with these enhanced integration capabilities.

#1: Enter vehicle data almost instantly

When dealers purchase vehicles at auction, information for every vehicle has to be entered into the DMS. Because dealers typically use their inventory tool to acquire vehicles at auction, the information already in the inventory tool needs to be transferred into the DMS. Some DMS systems cannot accept this information from an outside source like an inventory tool, so all the material must be manually entered into the DMS. Other DMS systems can obtain this information from an inventory tool overnight. So, dealers have to wait overnight or manually enter it into their DMS if their time is limited. If a list has 20 vehicles, manually entering this information can take hours. Plus, time is not the only issue. Entering data into two systems increases the risk of manual errors.

Fortunately, DealerSocket Inventory+ is integrated with IDMS and Auto/Mate DMS. When dealers go to auction, they can scan the VIN into their Inventory+ mobile app or select it from the auction’s run list on the app to appraise and purchase a vehicle. After purchase, they can then immediately add that vehicle into their inventory. That vehicle’s basic info is automatically pushed into the DMS, so multiple entries are not required.

#2: Effectively manage trade-in appraisals

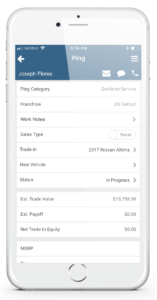

Customer trade-ins are typically appraised in the inventory tool. But trade-ins most often initially appear as part of sales lead opportunities in the CRM. This means both systems need a trade-in vehicle’s info, which requires duplicating information into both systems. Using the DealerSocket integrated systems, you can quickly manage trade-ins without entering data multiple times. Here’s how:

#3: Desk deals effectively

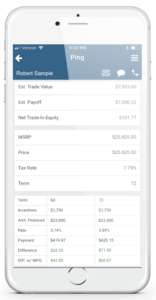

A standard sales deal begins with an opportunity in the CRM. The inventory tool and DMS provide vital support so that your dealership can complete these deals successfully. When you start working on a sale by entering the customer’s personal and trade-in vehicle information into the CRM to desk the deal, this same information will need to be available to the DMS and inventory tool as well. This can lead to excess time spent reentering the same information into three different systems to complete one deal.

A standard sales deal begins with an opportunity in the CRM. The inventory tool and DMS provide vital support so that your dealership can complete these deals successfully. When you start working on a sale by entering the customer’s personal and trade-in vehicle information into the CRM to desk the deal, this same information will need to be available to the DMS and inventory tool as well. This can lead to excess time spent reentering the same information into three different systems to complete one deal.

Unlike other systems, where double or triple entry is inevitable, you can utilize integrations within DealerSocket to push necessary data between systems in near real-time. The trade vehicle can be added to the CRM sales opportunity and moved into Inventory+ for evaluation. Then the figures are pushed back into the CRM, so you can review those figures to desk the deal.

After you complete the desking process, you can then submit the credit application in the CRM and send it out to finance vendors for bank approval. Finally, the whole deal can be pushed from the CRM into the DMS, along with the customer’s personal, credit, and trade-in vehicle information. With this information sent via the integration, which eliminates the need to enter it manually, contracting and booking the deal in the DMS is expedited, and the opportunities for data entry errors are diminished.

With an integrated CRM, DMS, and inventory tool, you can enter information in one system and view it almost immediately in all three.

#4: Account for price changes

Something as simple as changing the price of a vehicle can cause problems without enhanced integration capabilities. Some inventory tool integrations cannot push price changes into their DMS at all, meaning pricing done in the inventory tool will not be reflected in the DMS without manual entry. Dealers who wish to enter pricing in only one place must enter it into their DMS and wait for the DMS to push those changes into their inventory tool, which can take several hours or even an entire day. Other inventory tool integrations can update price changes into the DMS, but not in near real-time, which means pricing in the inventory tool may not be reflected in the DMS until the next day. Dealers who do not wish to wait have to change the price on both devices manually.

Fortunately, you can automatically view price changes in near real-time with integration capabilities from DealerSocket. Whether a dealer inputs the price into Inventory+ or the DealerSocket DMS, the price is immediately available to send out to third parties.

Find lasting success with DealerSocket

Connecting your systems is a win for your teams, customers, and business objectives. With integration capabilities, you can:

Save your dealership ample time, ensure accuracy, and reduce manual errors when integrating your DMS, inventory tool, and CRM with DealerSocket Inventory+. Visit dealersocket.com or give us a call at 888-993-1237 to get started today!

WESTLAKE, T.X. — May 17, 2021 — Solera Holdings, Inc. (“Solera”) today announced that it will acquire Omnitracs, a complete fleet management platform, and DealerSocket, a leading SaaS provider to the automotive industry. These acquisitions will extend Solera’s position as the preeminent global data intelligence and technology leader serving all constituents engaged in vehicle lifecycle management.

Global Leadership in Vehicle Lifecycle Management

With operations in more than 90 countries, Solera is the global technology leader operating in a highly complex vehicle lifecycle management ecosystem. Solera’s software and unique data assets power the value-chain of a vehicle from purchase to claims, repair and resale. These acquisitions will build upon Solera’s strategy to minimize complexity and reduce friction at all touchpoints in the vehicle lifecycle with fully integrated intelligent technology platforms.

“Solera is the driving force behind the rapid digitization of the vehicle lifecycle, delivering intelligent, data-driven, mission-critical solutions for our customers,” said Darko Dejanovic, Chief Executive Officer of Solera. “These highly strategic acquisitions will enable us to expand into adjacent verticals and capitalize on emerging trends in our industry. Solera’s unique position in a large and growing market allows us to transform the industry through innovation, proprietary data assets, unmatched scale and deep customer relationships.”

With Omnitracs, Solera will offer a unified platform that encompasses safety, productivity and maintenance solutions for commercial fleets.

“By joining Solera, Omnitracs will be able to further extend our converged solutions, both in and on the vehicle, into fleet lifecycle management services while also extending our access to new markets,” said Ray Greer, Chief Executive Officer of Omnitracs.

The addition of DealerSocket’s cutting-edge platform completes an end-to-end suite of solutions for automotive dealerships, combining customer acquisition and retention solutions, inventory management, dealership management systems, e-titling and a unique service and maintenance platform.

“The combination of DealerSocket with Solera allows us to offer dealerships a fully unified platform to simplify workflows and enables us to become the digital backbone across all areas of a connected dealership, simplifying and improving the retail experience. We are thrilled to join the Solera team,” said Sejal Pietrzak, Chief Executive Officer of DealerSocket.

The acquisitions are expected to close during the second quarter of calendar year 2021, subject to definitive agreements that will include customary closing conditions, including regulatory approvals. Financial terms were not disclosed.

Kirkland & Ellis LLP is advising Solera on the acquisition. Greenberg Traurig, LLP is serving as legal counsel to Omnitracs and Ropes & Gray LLP is serving as legal counsel to DealerSocket.

About Solera

Solera is a global leader in risk and asset management data and software, empowering companies across the automotive and insurance ecosystem with trusted solutions to support connectivity across the vehicle value chain. Solera’s solutions bring together customers, insurers, and suppliers, empowering smarter decision-making through service, software, enriched data, proprietary algorithms, and machine learning that come together to deliver insight and are designed to ensure customers’ vehicles and property are optimally maintained and expertly repaired. Solera serves over 235,000 customers and partners in more than 90 countries across six continents. By drawing on the market-leading solution capabilities and business process best practices from its technologies around the world, Solera provides unsurpassed scale and strength with superior performance while delivering innovation to move the industry forward.

About Omnitracs

Omnitracs offers the only complete fleet intelligence software platform. Serving the largest for-hire and private fleets in the transportation and distribution industries, Omnitracs’s best-in-class solutions accelerate business success, improve efficiency, and enhance the driver experience for nearly 15,000 customers who collectively travel 250 million miles per week. Omnitracs pioneered digital transformation in trucking more than 30 years ago, and today offers a one-stop shop for enterprise-grade, data-driven solutions across compliance, telematics, workflow, routing, and video safety in over 50 countries across the globe. For more information, visit www.omnitracs.com.

About DealerSocket

DealerSocket serves over 9,000 automotive dealerships with best-in-class solutions for customer relationship management, digital retailing/marketing, websites, inventory management and analytics solutions, as well as leading enterprise-level dealership management systems. DealerSocket solutions transform the automotive experience with innovations and unparalleled, award-winning customer service. For more information, visit www.dealersocket.com.

Cautions Regarding Forward-Looking Statements

This press release contains forward-looking statements, including statements about: the expected execution of definitive agreements relating to, and expected consummation of, Solera’s acquisitions of Omnitracs and DealerSocket (together, the “Acquisitions”); the expected financial, operational and strategic benefits of the Acquisitions; the expected benefits and value of current and future products and services to Solera’s, Omnitracs’s and DealerSocket’s customers, either alone or in conjunction with the products and services of other Solera group companies; and operational efficiencies that may be achieved by the combined companies as a result of the Acquisitions. These statements are based on Solera’s current expectations, estimates and assumptions and are subject to many risks, uncertainties and unknown future events that could cause actual results to differ materially from such forward-looking statements. Solera is under no obligation to (and specifically disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

Contacts

Joele Frank, Wilkinson Brimmer Katcher

Jed Repko / Ed Trissel

212-355-4449

[email protected]

SOURCE Solera Holdings, Inc.

By Winston Harrell, Strategic Growth Manager

There is no right way to data mine; the only wrong thing you can do is let all those sales prospects sit untouched in your CRM. Because on any given day, someone in your customer database is thinking about purchasing a new car. The key is not to be afraid to experiment, especially when it comes to the search parameters you use to ID those in-market opportunities.

That holds true when using a data mining tool does the searching automatically. Your store’s average credit score, time of ownership, and annual driving miles can make all the difference. And as we all know, being the first to engage means higher margins. Best of all, you don’t have to pay a lead provider to deliver the business you already earned. Let’s dig into six prospect list you can optimize by simply doing a little homework.

List No. 1: Customers Who Can Lower Their APR While Trading Up

Interest rates are historically low, which means there are opportunities to help past buyers take advantage. Typically, these will be customers with an APR above a certain range. Getting them back into your showroom could mean a new or newer vehicle and potentially saving them thousands of dollars in interest.

Search parameters for this list include average credit score, loan term, and down payment. Specifics vary depending on location. For example, in an area with an average credit score of 650 or less, use 2.5 years or greater as a timeframe of ownership. The reason is that’s the amount of time it takes for consistent payments to improve a credit score.

In fact, it’s a good idea, especially during these uncertain times, to conduct a regular credit bureau analysis. What you need is a credit tier profile of your customers. This knowledge cannot only be used for prospecting, it can guide your inventory sourcing strategy when finance sources tighten up.

List No. 2: Customers Who Can Lower Their Payment While Trading Up

Equity isn’t the only way to help a customer lower their payment while trading out to a new car. Your OEM’s current incentives, as many new car owners discovered through the pandemic in 2020, can also help lower payments. For example, it may be possible to identify car owners who are in a less equitable position but who are eligible for a large rebate, which can help offset their lack of equity.

To identify this list, follow the guidelines of the book your dealership uses to estimate current equity, then adjust according to incentives offered. For example, Kelley Blue Book wholesale plus $500, or NADA average trade-in minus $500.

Some data mining solutions will automatically match a prospect’s current vehicle with a vehicle in your inventory that’s similar to the one they already own. That makes it easy to send emails containing your lower payment offer and a link a vehicle details page highlighting the current model-year version of their vehicle.

List No. 3: Customers Who Declined High-Cost Service Repairs

When customers decline recommended services, it might be an indicator that the repair bill was more than the person was willing to invest. That means there’s a good chance they are weighing their options: Pay $3,000 for that repair or just buy a new car? So, set your data mining tool or search for customers who declined repair estimates above $1,500 and $3,000. Success will depend on brand and location, so do some experimenting.

List No. 4: Customers Approaching End of Lease

What makes identifying end-of-lease customers a popular activity is there’s a deadline for them to make a decision and we know the date. So, it’s a far easier process to set up that campaign than one that centers on equity position. The key is to engage these customers six months out and increase the frequency of communications at the deadline approaches.

When building your lists or setting your data mining tool’s parameters, you may want to target a specific model your used car manage wants to add to inventory. You can also search by specific ZIP code, area code, distance to the dealership, or even finance source. Based on the lease criteria, for instance, certain finance sources may come out with lease pull-ahead program that targets Ford F150s.

List No. 5: Customers Approaching End of Finance Term

As customers approach the end of their finance terms, they may be open to considering a new vehicle. Parameters on what the right timeframe is can be a bit tricky. Location and clientele are major considerations. For example, if the majority of your finance deals are for six years, it might be worth contacting some of your customers as soon as three years into the loan.

Customers who drive 12,000-plus miles per year will be open to trading their car at a higher frequency rate than those who drive only 8,000 miles per year. Other parameters to experiment with include equity position and payments.

The key with this list is to find owners who are past the honeymoon phase of ownership. Similar to the seven-year itch in a marriage, there is a period where most car owners don’t hate their vehicles but would be willing to trade up if presented with the option.

List No. 6: Customers in an Equity Position on Their Current Vehicle

If you’ve ever data mined, you are familiar with this list. It doesn’t matter when a customer purchased their vehicle. If they have a certain amount of equity, it can be traded in for a newer vehicle. During periods like the one we’re in today, this list can be especially helpful to your used car manager.

In addition to identifying equity positions, I recommend slanting search parameters toward what the used car manager’s needs are. Specify makes, models, mileage, and other criteria that you want in used inventory. Once you pull these lists from your CRM, enroll prospects into campaigns that utilize email, text, and phone calls from your BDC or sales team.

While not as “hot” as new lead submissions, these lists should yield many potential car buyers. Plus, it’s a great way to check in with your customers. To make the effort worthwhile, ensure that your salespeople or BDC agents know how to qualify prospects. If someone isn’t interested, close them out and move on.

As previously mentioned, there’s no wrong way to mine your customer database, but a little homework and some experimenting will go a long way toward a fruitful data-mining expedition. But you better have a good process that’s written down, implemented, and managed.

# # #