There’s a lot more involved in securing a finance approval than a credit score, so why aren’t we making sure today’s digital car buyer understands the factors that put deals over the curb?

By Gregory Arroyo

During my magazine days, one of my go-to contributors was an F&I trainer who, for a few years, landed speaking opportunities based on the following session title: “A Credit Score Isn’t F&I.” It remains his mantra even today.

Now, the trainer’s message targeted F&I producers and sales managers who didn’t understand deal structure and wrongly believed a 740 credit score guaranteed an approval. Not even an 800 score is an automatic approval if the customer doesn’t have money down and didn’t land on the right car.

That trainer and his session came to mind during a recent conversation about digital retailing with Winston Harrell, a more than 30-year industry veteran who serves as one of DealerSocket’s Strategic Growth Managers. He believes digital retailing is a good additional step in the process and one that consistently delivers high-quality leads.

“What I like about digital retail, especially right now [during COVID-19], is it affords an opportunity for customers to have a better experience in their information-gathering phases,” he says.

However, Harrell wondered if we’re setting up today’s digital car buyers for failure by allowing them to think a credit score is all that’s involved in securing a finance approval. Sure, a credit score can help determine rate and term, but a credit score isn’t what finance sources use to determine the single greatest factor involved in an approval: Ability to pay.

“That’s why I believe SocketCredit is a far more important tool right now,” he says. “It tells me right from the beginning where I’m going to be with that customer that just came through our PrecisePrice tool.”

Harrell’s point is that since today’s digital retail tools allow customers to work deals backward, dealers need the CRM to be able to do the same. In DealerSocket’s case, SocketCredit enables dealers to manage the credit application process within the CRM — from receipt of the online credit application and completion of the required compliance checks to submission for finance approval and receipt of the finance source’s decision.

So, no, this isn’t a plug for DealerSocket’s platform, because what Harrell observed is a crucial entry point for the showroom process — the hand-off, if you will. Here’s a scenario of how that might work:

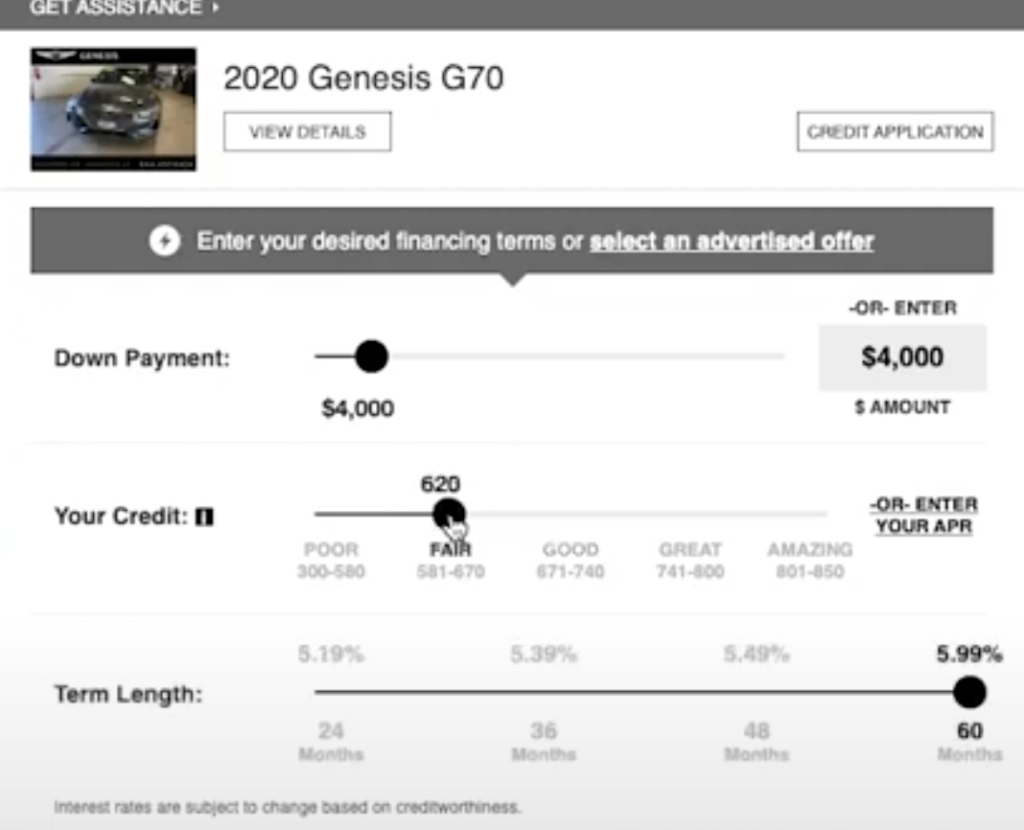

Let’s say a customer engages your digital retail tool. She sets the sliders to her current credit score, desired down payment, and term length. Unsatisfied with the monthly payment, the customer enters an APR for which she thinks she qualifies. Satisfied, the customer submits her customized deal to the dealership.

Once the deal appears in the CRM, Harrell says the customer should be entered into a campaign that calls for a sales staffer to reach out immediately. Now, there are two questions Harrell says the salesperson needs to pose once connected: Where did you get your credit score? And where did you get the rate you plugged into the tool?

If the answer is, “My credit union,” the response should be, “Fantastic!” Next, the salesperson needs to ask if the customer completed a credit application with the credit union. If the rate and score were based on a simple phone call, here’s what you want to say:

“Great! A credit score does matter, but there’s so much more that comes into play. I work with 28 finance sources that may be able to do better than what you saw on PrecisePrice (managing expectations). Would you like me to review those for you? I’ll shoot you a text/email with a link authorizing a credit inquiry. Fill it out, and I can see which one of those programs works best for you. Is that OK?

Yep, with a few trial closes, you just might capture the most critical element to putting a car deal over the curb: the customer’s financing.

And here’s the beauty of Harrell’s scenario: All that data you collected on the customer — vehicles of interest, compliance checks, credit app, authorization to pull credit, and lender decisions — are accessible through the CRM.

That means the next time a regulator questions a Red Flag verification or a customer wants proof your dealership had authorization to pull credit, “you don’t have to go into multiple pieces of software to dig it up.”

Gregory Arroyo is the former editor of “F&I and Showroom” and “Auto Dealer Today” magazines. He now serves as senior manager of strategic content for DealerSocket. Email him at [email protected].