CRM: Critical Dealer Tool

Why is CRM not included in the digital retailing discussion?

While there is plenty of attention on digital retailing during the pandemic, there has been little attention paid to how CRM help dealers navigate this period of social distancing. But it’s understandable. The CRM isn’t the new shiny object like digital retailing, and COVID-19 certainly reignited the digital-retail discussion. However, there’s no doubt of the importance of appointment-setting during COVID-19, especially for dealerships located in markets where sales were limited to appointment-only. It’s an art that predates the CRM, but, thanks to that important front-end tool, appointment-setting has become a science for some operations.

What often gets overlooked is just how often CRM providers update this critical tool. In DealerSocket’s case, the cadence is every two weeks. And the focus of late for DealerSocket is appointment-setting, with texting now a key component, thanks to dealer feedback.

Auto Buyers Prefer Texting

Recently, a California dealership customer began sending every internet lead received an initial opt-in text. If there was no response within a few minutes, the following text message — one that garners a response 70% of the time — was sent, “We just received your internet request, and we have a few questions. Do you prefer a call or a text?”

That dealership sent and delivered 26,617 texts.

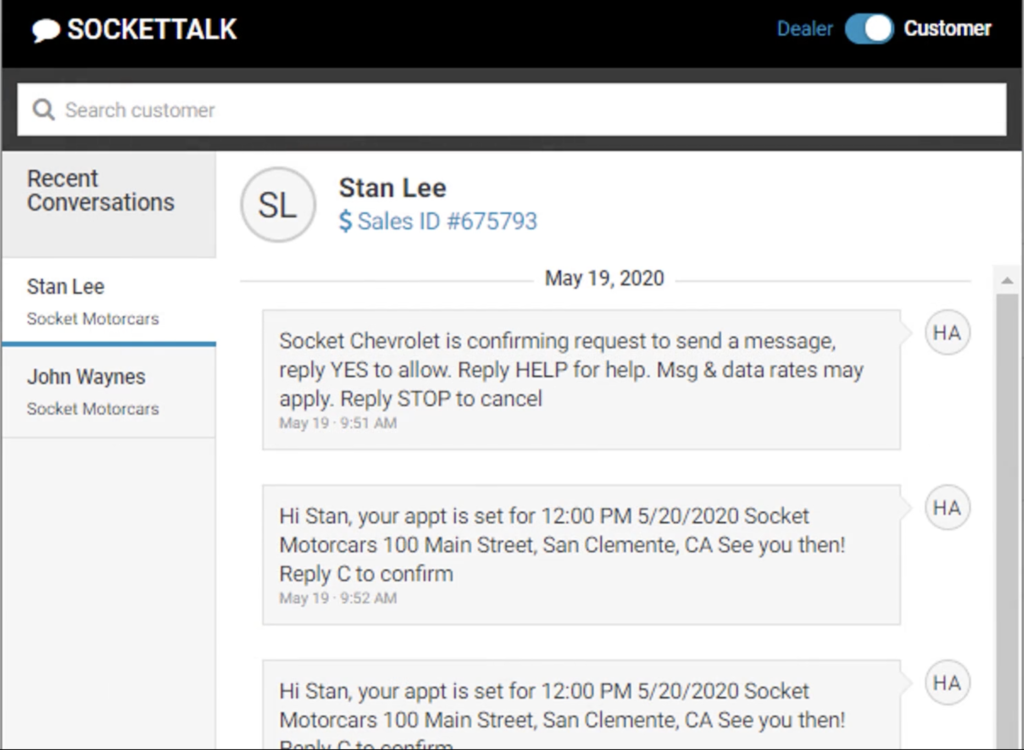

Then there’s Rashad Tillman, who manages a centralized BDC for a two-rooftop independent group in Southern California. With a keep-it-simple approach, he operates under the belief that a successful road to the sale requires five yeses from a customer. The use of DealerSocket’s SocketTalk texting tool usually accounts for two of those yeses, starting with the opt-in text.

“All we’re looking for is a reply. Once we get one, we’re in control,” Tillman says. And once a customer opts in, the following text is sent, “’We received your lead for the [make and model], which we have available. Do you have time today to test-drive the vehicle?’”

“That usually results in a reply,” Tillman says. “I’ve been working with DealerSocket’s CRM for seven years now, and I figured out real early that texting is now the primary form of communication. So, we try to eliminate as much conversation as possible.”

In one month, Tillman’s 20-member team sent and received 59,402 text messages through the CRM’s SocketTalk texting tool, with two members logging 2,900 sent and received texts for the month. Tillman notes that texting accounts for 80% of his department’s activity when working a lead, which is he says knowing how to configure DealerSocket’s CRM dashboard correctly is critical to making sure no opportunity falls through the cracks.

Better Manage Leads and Opportunities

With DealerSocket’s CRM, managers don’t have to dig into the solution’s reporting tools to keep tabs on their team’s lead-handling activities. Merely creating a dashboard widget for web leads allows managers like Tillman to keep tabs on every opportunity and every text or email exchange. That’s where he says most managers go wrong. They have the talent and skills, but they resist to allow technology to augment their abilities.

In fact, the use of technology is how managers like Tillman are keeping their dealerships in the game when today’s car buyers are shopping more brands, more vehicles, and more dealerships than those car-buyer studies predicted they would four to five years ago. The latest data on that front comes from a study commissioned by Urban Science, which showed that the average car shopper is considering 2.6 brands, visits 2.5 dealerships, and submits, on average, three lead forms.

Regardless of whether your BDC staffers or sales teams are selling appointments or demonstrating to customers a willingness to be shopped to win their business, converting a lead into an appointment requires a CRM-driven process that doesn’t end once the customer says, “yes.”

The best part of a CRM-driven appointment-setting process is that it can be automated every step of the way. In the case of DealerSocket, our CRM’s Campaign Manager allows you to assign your operation’s best word-tracks to a BDC staffer’s scheduled response to an inquiry. It can also automate appointment reminders, confirmation communications, and follow-ups. Then there’s the CRM’s Business Rules automation tool. This allows managers to initiate activities such as vehicle prep and enrollment of customers into appropriate campaigns.

With this, CRM should be included in the digital retailing discussion. When a customer structures a deal through your website’s digital retail tool and submits their information, the question dealers need to answer is, “what does the experience look like when it does?”

The current shortage of inventory has been a major challenge for the entire automotive industry: sales reps who depend on commission-based pay, auto workers facing a wave of temporary layoffs, suppliers grappling with the temporary shutdowns imposed by the automakers, and, of course, their customers. Everyone is feeling the impact of the new vehicle inventory shortages made even worse by the global semiconductor shortage in early 2021.

However, one group has been able to turn the inventory crunch to their advantage: dealers. With hardly anything new to sell, dealers are raking in more gross profit than ever.

Of course, the only hitch in what is otherwise such a sweet high for dealers is that you have to have inventory to sell if you want to remain on the upside of the supply-and-demand game of tug of war.

With experts predicting that the shortages will continue through mid-2022, there is no better time to stay in the lead and get aggressive with sourcing efforts. Dealers are competing with rental car companies and large, national used-car dealerships for pre-owned inventory. If you’re relying on the same old sourcing techniques, you’ll be running out of cars sooner rather than later.

Here are a few ideas that could help increase inventories despite the current supply-demand mismatch

Contact Unsold Customers

Make call lists of unsold customers going back three months. Some bought elsewhere, but some did not buy at all. Vehicles belonging to those non-buyers may be worth thousands more than they were two months ago. Reach out to them. It’s worth a try.

Buy Lease Returns

Buy any and every possible lease return you can: regardless of brand or customer. Don’t pass on a vehicle just because it has damage. Age means nothing. Advertise and market the heck out of this.

Let customers know they might profit from any pre-set residual value from lease inception. For example, if that purchase option was $10,000 and a dealer can pay the customer $14,000 for the lease return, that’s $4,000 cash in the customer’s pocket.

If you can’t sell the vehicles, wholesale them. The usual rule of thumb with wholesale is that dealers may break even, lose $100, or make $100. Now dealers are making $3,000 profit on vehicles they would have called junk two years ago. Dealers are making $70K or $80K a month in wholesale profit. It’s a whole new profit center.

Establish a Service Drive Appraisal Program

There’s a right way and wrong way to source pre-owned vehicles from service customers. First, don’t put existing salespeople in the service department and expect them to be successful. Hire someone to work exclusively in the service department and pay them a base salary.

Don’t approach customers in the service drive. You don’t want to scare them away, so place signage in your service drive that promotes your free market valuation. When customers raise their hands, only then can the salesperson engage. For customers who don’t raise their hands, leave an appraisal on their front seat.

Pay More, Sell for More

Some dealers don’t want to spend ridiculous amounts of money to buy pre-owned inventory. Yes, vehicles are way overvalued. But there’s no inventory.

Pay more to get cars that you would have passed on two years ago but then sell for more. If you don’t pay more, you’ll be sitting with no inventory – so get in the game.

Cast your marketing net wider. Customers are willing to drive a long way to get the vehicle they want. Dealers are holding their prices firm, and customers are willing to pay. Many stores are averaging $3,000 to $6,000 in front-end profit per vehicle. Don’t bother looking at market data to see what cars are selling for because it means nothing.

Just keep raising prices. Your competitors are, and they’ve been very successful. Many dealers are having the best months they’ve ever had in their history. Cars are routinely priced at 135 percent to 145 percent to market, and customers are paying.

This craziness will probably continue for at least another year, so it’s time to think outside the box when it comes to sourcing pre-owned inventory. Hold free car clinics, leave cards on vehicles in grocery store parking lots, whatever it takes. Gather your team and brainstorm. Inventory won’t drive itself onto your lot.

Discover how you can make increasing Profit Per Day™ easier by visiting https://dealersocket.com/products/inventory-management/

DealerSocket’s Chief Product and Technology Officer Alok Tyagi recently grabbed the #2 spot in a list of the Top 25 Software Product Executives of 2021, ranked annually by The Software Report.

“I am thrilled to receive this honor and be recognized for the tremendous work we have done as a company in the last year to create a unified solution for our dealership customers,” said Tyagi. “Our software focus is on our ability to serve as the digital backbone of a connected dealership, improving productivity and guiding the customer journey from online to showroom.”

Tyagi joined DealerSocket in 2020, bringing more than 25 years of hands-on leadership experience in the technology industry. Tyagi’s expertise includes product strategy, product management, design and development of market-leading enterprise software products. His specialty is re-innovating existing product portfolios to improve the user experience.

Tyagi is a champion of digital transformation; someone who is known for taking the time to mentor entrepreneurs and advise start-up companies. Prior to joining DealerSocket, Tyagi was the chief technology officer at RealPage, a senior advisor on the product and technology council at Mainsail Partners, and chief product and technology officer at GTreasury. Tyagi has extensive experience leading CRM product organizations at industry-leading companies like Oracle, Peoplesoft, JDEdwards and Sage.

The Software Report’s annual list of Top 25 Software Product Executives honors individuals who are the driving force for software innovation, improved user experience and the genesis of company revenue growth and continuity. They have also notably led successful launches over the past year in response to evolving market demands.

Data-mining expert digs into six popular data-mining lists and offers a few considerations on how to optimize them for success.

By Winston Harrell, Strategic Growth Manager

There is no right way to data mine; the only wrong thing you can do is let all those sales prospects sit untouched in your CRM. Because on any given day, someone in your customer database is thinking about purchasing a new car. The key is not to be afraid to experiment, especially when it comes to the search parameters you use to ID those in-market opportunities.

That holds true when using a data mining tool does the searching automatically. Your store’s average credit score, time of ownership, and annual driving miles can make all the difference. And as we all know, being the first to engage means higher margins. Best of all, you don’t have to pay a lead provider to deliver the business you already earned. Let’s dig into six prospect list you can optimize by simply doing a little homework.

List No. 1: Customers Who Can Lower Their APR While Trading Up

Interest rates are historically low, which means there are opportunities to help past buyers take advantage. Typically, these will be customers with an APR above a certain range. Getting them back into your showroom could mean a new or newer vehicle and potentially saving them thousands of dollars in interest.

Search parameters for this list include average credit score, loan term, and down payment. Specifics vary depending on location. For example, in an area with an average credit score of 650 or less, use 2.5 years or greater as a timeframe of ownership. The reason is that’s the amount of time it takes for consistent payments to improve a credit score.

In fact, it’s a good idea, especially during these uncertain times, to conduct a regular credit bureau analysis. What you need is a credit tier profile of your customers. This knowledge cannot only be used for prospecting, it can guide your inventory sourcing strategy when finance sources tighten up.

List No. 2: Customers Who Can Lower Their Payment While Trading Up

Equity isn’t the only way to help a customer lower their payment while trading out to a new car. Your OEM’s current incentives, as many new car owners discovered through the pandemic in 2020, can also help lower payments. For example, it may be possible to identify car owners who are in a less equitable position but who are eligible for a large rebate, which can help offset their lack of equity.

To identify this list, follow the guidelines of the book your dealership uses to estimate current equity, then adjust according to incentives offered. For example, Kelley Blue Book wholesale plus $500, or NADA average trade-in minus $500.

Some data mining solutions will automatically match a prospect’s current vehicle with a vehicle in your inventory that’s similar to the one they already own. That makes it easy to send emails containing your lower payment offer and a link a vehicle details page highlighting the current model-year version of their vehicle.

List No. 3: Customers Who Declined High-Cost Service Repairs

When customers decline recommended services, it might be an indicator that the repair bill was more than the person was willing to invest. That means there’s a good chance they are weighing their options: Pay $3,000 for that repair or just buy a new car? So, set your data mining tool or search for customers who declined repair estimates above $1,500 and $3,000. Success will depend on brand and location, so do some experimenting.

List No. 4: Customers Approaching End of Lease

What makes identifying end-of-lease customers a popular activity is there’s a deadline for them to make a decision and we know the date. So, it’s a far easier process to set up that campaign than one that centers on equity position. The key is to engage these customers six months out and increase the frequency of communications at the deadline approaches.

When building your lists or setting your data mining tool’s parameters, you may want to target a specific model your used car manage wants to add to inventory. You can also search by specific ZIP code, area code, distance to the dealership, or even finance source. Based on the lease criteria, for instance, certain finance sources may come out with lease pull-ahead program that targets Ford F150s.

List No. 5: Customers Approaching End of Finance Term

As customers approach the end of their finance terms, they may be open to considering a new vehicle. Parameters on what the right timeframe is can be a bit tricky. Location and clientele are major considerations. For example, if the majority of your finance deals are for six years, it might be worth contacting some of your customers as soon as three years into the loan.

Customers who drive 12,000-plus miles per year will be open to trading their car at a higher frequency rate than those who drive only 8,000 miles per year. Other parameters to experiment with include equity position and payments.

The key with this list is to find owners who are past the honeymoon phase of ownership. Similar to the seven-year itch in a marriage, there is a period where most car owners don’t hate their vehicles but would be willing to trade up if presented with the option.

List No. 6: Customers in an Equity Position on Their Current Vehicle

If you’ve ever data mined, you are familiar with this list. It doesn’t matter when a customer purchased their vehicle. If they have a certain amount of equity, it can be traded in for a newer vehicle. During periods like the one we’re in today, this list can be especially helpful to your used car manager.

In addition to identifying equity positions, I recommend slanting search parameters toward what the used car manager’s needs are. Specify makes, models, mileage, and other criteria that you want in used inventory. Once you pull these lists from your CRM, enroll prospects into campaigns that utilize email, text, and phone calls from your BDC or sales team.

While not as “hot” as new lead submissions, these lists should yield many potential car buyers. Plus, it’s a great way to check in with your customers. To make the effort worthwhile, ensure that your salespeople or BDC agents know how to qualify prospects. If someone isn’t interested, close them out and move on.

As previously mentioned, there’s no wrong way to mine your customer database, but a little homework and some experimenting will go a long way toward a fruitful data-mining expedition. But you better have a good process that’s written down, implemented, and managed.

# # #

COVID-19 confirmed that you don’t have to be the cheapest to move pre-owned inventory. Inventory management expert says it’s time for a new approach.

By Darren Militscher

3 Inventory Categories

<>

Tactical Pricing Changes

Darren Militscher is a nearly 20-year veteran of the automotive industry who serves as a Senior Strategic Growth Manager for DealerSocket. He started his career working on the inventory management solution that would become Inventory+. Email him at [email protected].

By Darren Harris

In 2012, my then two-year-old son, Henry, wasn’t displaying the typical behavioral attributes of a child his age. He was avoiding direct eye contact, wasn’t talking, and was very sensitive to loud noises. My wife and I researched the internet and finally concluded to have him assessed for Autism Spectrum Disorder (ASD). Upon receiving the formal diagnosis of Autism, my wife and I began looking for answers and guidance on how to proceed moving forward. To say we were overwhelmed looking for answers would be a major understatement.

Since that time, we’ve learned much about Autism and how to help Henry have the most productive life possible. It hasn’t been an easy road, nor will it be in the future; however, diagnosing Henry when we did helped us provide early intervention, which sets him up for the best success possible.

Some of the things we’ve learned about Autism include:

- 1 in 54 children in the U.S. is diagnosed with an Autism Spectrum Disorder (ASD)

- Boys are four times more likely to be diagnosed with Autism than girls

- Autism can be reliably diagnosed as early as age two

- Autism affects all ethnic and socioeconomic groups

- Early intervention affords the best opportunity to support healthy development and deliver benefits across the lifespan

(Source: www.autismspeaks.org)

Henry is the best part of our family. He loves drawing, movies, his mother and siblings, nature, maps, animals, state birds, state flowers, In-N-Out Burger, bacon, and hot dogs. His favorite animal is a platypus, and we are his biggest fans.

Join me in raising awareness today, April 2nd, by wearing blue and pointing people to the Autism Speaks website at www.autismspeaks.org, should they have any questions or want to learn more.

The history of Inventory+ provides a glimpse into why it’s a profit-driven inventory management solution built for dealers.

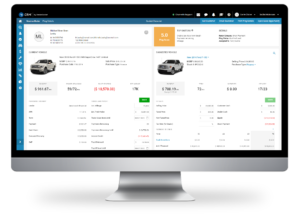

Inventory+ is a pricing, merchandising, and syndication machine, but at its core, it is powered by the Ideal Inventory Model™, an algorithm that focuses on profit per day. It is also the culmination of multiple tools and products that have led it to become as powerful as it is today. Since its inception, it has been a tool to help dealers manage their inventory from acquisition to disposition with a focus on increasing front-end profit for dealerships.

Inventory+ uses data-driven analytics to deliver quick answers about vehicles in a dealer’s inventory and market to help make informed stocking and pricing decisions. More importantly, its focus on inventory — from acquisition to disposition — is designed to drive profits for dealerships.

It was the foundation of two inventory software platforms — AAX and eCarList — that formed Inventory+.

Simplifying Vehicle Listings

The founder of eCarList, Len Critcher, had a dealership that sold vehicles entirely online. Although online sales were taking off, there was a lack of efficient software tools to create vehicle listings. The task at the time was manual and quite tedious.

Determined to simplify the process, Len, aided by a software developer, crafted a listing tool that housed information vital to online vehicle sales, such as photos, descriptions, and prices. The tool would then load that information onto third-party vehicle-shopping sites.

Len’s online car sales took off, and he quickly recognized that his tool could be adapted for use by other dealerships. The software developer moved into some extra office space at a shipping company in suburban Dallas, and eCarList, an automotive inventory and marketing software company, was born.

While eCarList was getting started, a shipping brokerage handled the shipment needs for over 200 dealers. It was realized that another essential tool for dealers could be included within eCarList – transportation management. Thus, a feature was added that allowed dealers to notify their shipping company when a vehicle was sold and ready for transport.

The majority of the dealerships served by the shipping brokerage were among the first to sign up for eCarList. It enabled their cars to be posted online faster, and they were excited that they could just click a button within the software, and an 18-wheeler would be sent to pick up their car.

As the software technology grew, the shipping business was exited, and eCarList saw the debut of one of its most popular enhancements, the TrueTarget™ mobile app, which allowed users to appraise, price, and manage inventory on the go.

AAX + eCarList

Both eCarList and AAX emerged in the early 2000s, when online retailing was in its infancy. Many features that appealed to dealers then continue to appeal to them now, though these features have been enhanced and refined.

One of AAX’s major strengths was its integration with a dealership management system to analyze past sales transactions and determine which vehicle makes, models, and trim levels sell fastest and for the most profit.

Those vehicles made up a dealership’s Ideal Inventory Model and still do.

Dealertrack Technologies integrated the products after acquiring AAX in 2009 and eCarList in 2011.

Using technology to enhance dealership profits isn’t a new notion for DealerSocket. So, in 2015, Inventory+ became part of DealerSocket’s suite of products.

Taking Inventory Management to the Next Level

Since then, particularly in 2019 and 2020, many new features have been released, and the software has been placed on a new platform. Inventory+ now has a new look and feel. It is nimble, intuitive, and easy to use, whether working with inventory at a single rooftop or across hundreds of dealerships.

Users can set up and save workflows for daily tasks, reducing the time to complete those tasks from hours to minutes, something that couldn’t be done in previous versions of the tool.

One dealer group describes the user experience as “frictionless.”

The enhanced pricing tool allows dealers to work faster and smarter. They can apply pricing rules to their inventory in bulk based on actual incentives from automakers while keeping an eye on other factors such as market conditions and competitors’ advertised prices in relation to MSRP.

In fact, one dealer repriced vehicles by exterior color as part of a Memorial Day promotion, discounting the prices of red, white, and blue vehicles in a matter of minutes.

Using the tool, the dealer searched for and pulled up red vehicles, hit “select all,” and updated their prices simultaneously. The same was done for white and blue vehicles, all within five minutes.

Additional Enhancements

Here are just some of the many Inventory+ enhancements made over the past year:

- The Ideal Inventory Model is more accurate and shows in greater detail how a dealership performs with similar vehicles being appraised, held in inventory, or considered for acquisition at auction. The goal is to show vehicle profit potential.

- Updated algorithms and data-cleansing technology enable better and more accurate snapshots of a dealership’s inventory, sales history with that inventory, and which vehicles are profitable.

- A new market graph, released earlier this year, provides greater visibility about price in the market by answering questions such as how a vehicle’s price in the market compares with its MSRP and how the price of a vehicle at a dealership compares with prices of similar vehicles at competitors. The graph also details how many of a specific vehicle competitors have for sale versus the number of similar vehicles in stock.

- Absolute Sourcing, also released this year, streamlines acquisitions by searching for and serving up ideal inventory matches missed during recent appraisals, available for trade at sister stores (if the dealership is part of a group), and available at auction.

- Inventory+ is now participating in General Motors’ Dealer Vehicle Inventory Management (DVIM) program, allowing GM dealerships using the inventory management tool to syndicate inventory to GM-participating website providers and programs, including the automaker’s Shop-Click-Drive e-commerce tool.

Since the early 2000s, software has been created to drive profitability at dealerships. In the past two years, innovation has accelerated. Now, more than ever, dealers need to evaluate their vendors and ask: Are they helping or competing against them?

DealerSocket’s Over the Curb blog goes one-on-one with Tony Graham, Auto/Mate’s new executive vice president and general manager.

By Gregory Arroyo

“It’s not the employer who pays the wages. Employers only handle the money. It is the customer who pays the wages,” reads the famous quote Tony Graham has displayed on his LinkedIn page. Sourced from a renowned car company founder, it has served as the backbone of his 27-year career in the car business.

Graham officially stepped in as the new executive vice president and general manager of DealerSocket’s Auto/Mate on Aug. 24, bringing a proven track record of success to a business unit the company acquired in February 2020.

The senior business leader is no stranger to the DMS space. Initially recruited by ADP in 1993 as director of product marketing following a seven-year stint with NCR Corp., Graham spent the next 26 years working tirelessly on behalf of retail automotive dealers in a variety of leadership roles for the DMS provider.

Credited with launching CDK’s Minority Dealer Business in 1999, the executive turned his idea to establish the company’s presence in that segment into a highly successful business. Graham also served as executive sponsor of the company’s diversity and inclusion initiatives, which included the creation of the ADP Minority Summer Internship Program and implementation of the company’s first diversity council, employee resource groups, and diversity training. After leaving CDK Global in 2019, the National Association of Minority Automobile Dealers (NAMAD) honored him with its prestigious Lifetime Achievement Award.

“Tony was a trailblazer as an executive with CDK and ADP,” said NAMAD President Damon Lester. “What he’s been able to do — not just for nonminority dealers but advocating and assisting in the plight of minority-owned dealerships — is a testament to his character. If Tony says he’s going to do something, he’s going to get it done.”

Ernest Hodge, president and CEO of Atlanta-based March Hodge Automotive Group, added: “I’ve known Tony for well over 20 years. The guy has a tremendous amount of integrity and empathy for his customers and just has a real passion for whatever he’s doing. He’s just outstanding.”

DealerSocket’s Over the Curb blog caught up with Graham just before his first day in his new role. Discussed were a range of topics, from COVID-19’s impact on dealers to his family, passion for coaching, and what he brings to DealerSocket.

DealerSocket: I know you’re a family man, so let’s start there.

Graham: I’ve been married to my wife Beverly for 32 years, but we’ve been friends for 40. We met as freshmen in college.

DealerSocket: That’s incredible. You also have three adult children, correct?

Graham: Yes, I have two daughters and a son. My oldest daughter, Ms. Toni, is 30 and works in the automotive industry. She’s a very successful sales manager at a Mercedes-Benz dealership and was a world-class sprinter at the University of Alabama. She was a Division I All-American.

My middle daughter, Ms. Taylor, is 27. She ran track and tennis in high school, but she didn’t do sports in college. She’s my scientist and works for the city of St. Petersburg, Fla. My son Palmer graduated from college this past December. He was a three-sport athlete in high school and played Division I college football. He now works for The Pfizer pharmaceutical company.

DealerSocket: Sounds like an incredible family. You describe yourself as a senior business leader and champion of diversity. Can you tell our readers about the latter?

Graham: Unfortunately, there’s no short answer to your question, but let me try. I was recruited into the industry in 1993 by what was then known as ADP Dealer Services. At the time, the Big 3 car companies — Ford, General Motors, and Chrysler — really emphasized diversification of their dealer network and had clear definitions of how they defined diversity. The automotive industry wasn’t very diverse at the time, but the Big 3 wanted to change that.

So, when I came to work at ADP, I recognized the opportunity to do the same. I had a vision, came up with a business plan, and turned that idea into a highly successful business. And it was a well-defined plan that included employee resource groups, diversity training, and a mentorship and internship program.

DealerSocket: ADP initially recruited you as a product marketer, correct?

Graham: Yes, I started out as director of product marketing before being elevated to vice president.

DealerSocket: You also ran ADP’s Canadian business, right? I think I read you led the struggling operation to the No. 1 sales ranking in ADP’s portfolio.

Graham: I did. It was a great experience. I spent a little over 18 months in Canada. We had a lot of success, and we had a lot of fun.

But let me add one thing: When I left Canada to become general manager of ADP’s Midwest region, I retained oversight of the company’s minority business and women business. I did the same when I oversaw the company’s Southwest region. Even when I became Chief Customer Experience Officer, they didn’t take my dealers away. And along the way, I started to put more focus on dealerships owned and operated by women.

I mention that because when you start something and you’re growing and building, you become the face of that part of the business.

DealerSocket: I was going to ask about the women retail business you also helped start. How was that different from the plan you developed for minority dealers?

“The two things I’m most proud of in my career are the number of employees I helped develop and grow as a mentor, and, second, that I had experience working with the smallest to the largest dealer operations.”

Graham: Let me start by saying that big companies always try to blur the waters a bit by including women in how they define minorities. I didn’t think that was right. Women deserve their own plan and focus. And I was lucky to have a woman who I worked with for 26 years lead that business.

DealerSocket: So, why did you depart CDK?

Graham: Have you ever gone to a party and promised yourself you’d only stay an hour? Then you end up staying for three. I feel I stayed too long. Many of the people I worked with and counted on to serve my dealers had left, so, again, I stayed too long.

At the same time, I always had it in my mind that I would retire from CDK Global at 55. I overshot that by 12 months before leaving at the end of June 2019.

I also wanted to be closer to my mother and my mother-in-law in Alabama, so my wife and I sold our house in Chicago. My last day with the company was June 30 (2019), and I was living in Huntsville, Alabama, by August.

DealerSocket: What do you consider to be your most significant accomplishment at CDK Global?

Graham: The two things I’m most proud of in my career are the number of employees I helped develop and grow as a mentor, and, second, that I had experience working with the smallest to the largest dealer operations.

DealerSocket: The National Association of Minority Automobile Dealers sent you off in a very nice way before you did, honoring you with its Lifetime Achievement Award at its annual convention that July.

Graham: When I announced my retirement to my dealers, they said, “Tony, we want to recognize you for all you’ve done for us. And you know what? I’m the only individual that’s not a dealer or an official with a car company to receive that award.

DealerSocket: That’s amazing.

Graham: What I will cherish from that night was the presentation. The dealer was so emotional that he couldn’t get through it. He said, “You’re too young; you can’t retire.”

DealerSocket: Was retirement not for you?

Graham: I like to keep myself busy. I founded my consulting firm, T. Graham Business Consulting and Advisory Services, and worked on some business initiatives. I also served as an adjunct professor at Calhoun College. I guess you can describe my short time away from this great business as a moment of reflection. My financial advisor called it a “halftime.”

You spend the first half of your career trying to make a name for yourself. Then there’s the second half, which is more about purpose. What will they write on your tombstone, right? My hobby is helping people, and so many people need help — young people who, based on their environment and family structure, need a positive role model in their life.

DealerSocket: I think I read you dedicated 20-plus years to coaching and mentoring.

Graham: Outside of raising my kids, that’s what I get the most gratification from — to see kids who never thought about college become the first in their family to not only go but finish. So I’ve helped many kids get in and through college, then I helped them find their first job after college. They always ask, “What can I do for you?” My response is always the same: “There’s nothing you can do for me, but you can do for someone else what I did for you. That’s how you pay me.” In my fraternity, Omega Psi Phi, Inc., we refer to that as UPLIFT.

DealerSocket: The world needs more Tony Grahams. So when did you get the itch to return?

Graham: I knew I wasn’t done, but I didn’t think I would actually come back to work for a technology company in the automotive industry. I started my consulting company and thought that would be my outlet. I guess I realized how much I missed working daily with my dealers, which I call friends.

At the same time, my phone started ringing with several prestigious offers from prominent automotive software companies. I decided to accept the offer from DealerSocket because I believe in the company’s core tenet of dealer-first and because I believe DealerSocket’s software is truly exceptional at helping dealers.

DealerSocket: Were you surprised by DealerSocket’s Auto/Mate acquisition?

Graham: I did have an idea that DealerSocket was going to be making some moves when I left CDK Global. Both DealerSocket and Auto/Mate were growing and taking market share, and I think a lot of people knew something was cooking. So, when the acquisition happened this past February, I wasn’t too surprised.

And I think it was a great move. Auto/Mate adds the missing piece for DealerSocket, which never had a franchised DMS. So, the acquisition immediately elevated the combined organizations, and I’m excited to be leading this because it represents an opportunity for dealers to work with a company that cares, is focused on customer service first and foremost, and spends a great amount of resources on innovation and investment in its software.

“Whether you’re a small dealer or a large dealer, COVID-19 has impacted you. And you had to change the way you conduct business; you had to change the process. You had to get creative.”

DealerSocket: So, what’s the approach?

Graham: That’s a great question. First, let me say that I have a lot of respect for Mike Esposito. He, Larry Colson, and the rest of the Auto/Mate team built a tremendous organization with an incredible culture, core values, and a dealer-first focus on everything they do.

With that said, I think the model is you first have to come in to listen, take in all that information, assess, and formulate a plan. As I said, Mike, Larry, and the other leaders have built a great company with an incredibly dedicated and talented team. So, I want to get to know the people and what drives that organization.

DealerSocket: So, it’s not a matter of dusting off the old playbook?

Graham: Let me answer your question this way: I love sports, but these days I enjoy watching them more than actually playing. Every year in the NFL or NBA, there are about four coaches that lose their jobs. Candidates come in to interview and present what they will do if they are named coach. I think that’s counter-intuitive. If you’re a defensive coach but don’t have the personnel to carry out that scheme, how will it work?

Yes, I have playbooks. But again, the model is you first have to come in to listen, take in all that information, assess, and formulate a plan.

DealerSocket: How does COVID-19 impact things?

Graham: Whether you’re a small dealer or a large dealer, COVID-19 has impacted you. And you had to change the way you conduct business; you had to change the process. You had to get creative.

Now everyone has to position themselves for the post-pandemic, which means the question becomes: How do you ready yourself? And I believe dealers have a window of 18 to 24 months to turn the answer to that question into a strategy powered by technology.

Dealers need to embrace technology more than they ever have, because it can be a competitive advantage. But here’s what I know about dealers: They do want innovation, good tech. But what they value most is service and support.

That’s why I’m proud to join a company that was proactive in its support of dealers through the pandemic. These are exciting times, and I’m ready to get to work. But at the end of the day, I’m back with my friends — my dealer friends. And they are going to be glad to see me.

There’s a lot more involved in securing a finance approval than a credit score, so why aren’t we making sure today’s digital car buyer understands the factors that put deals over the curb?

By Gregory Arroyo

During my magazine days, one of my go-to contributors was an F&I trainer who, for a few years, landed speaking opportunities based on the following session title: “A Credit Score Isn’t F&I.” It remains his mantra even today.

Now, the trainer’s message targeted F&I producers and sales managers who didn’t understand deal structure and wrongly believed a 740 credit score guaranteed an approval. Not even an 800 score is an automatic approval if the customer doesn’t have money down and didn’t land on the right car.

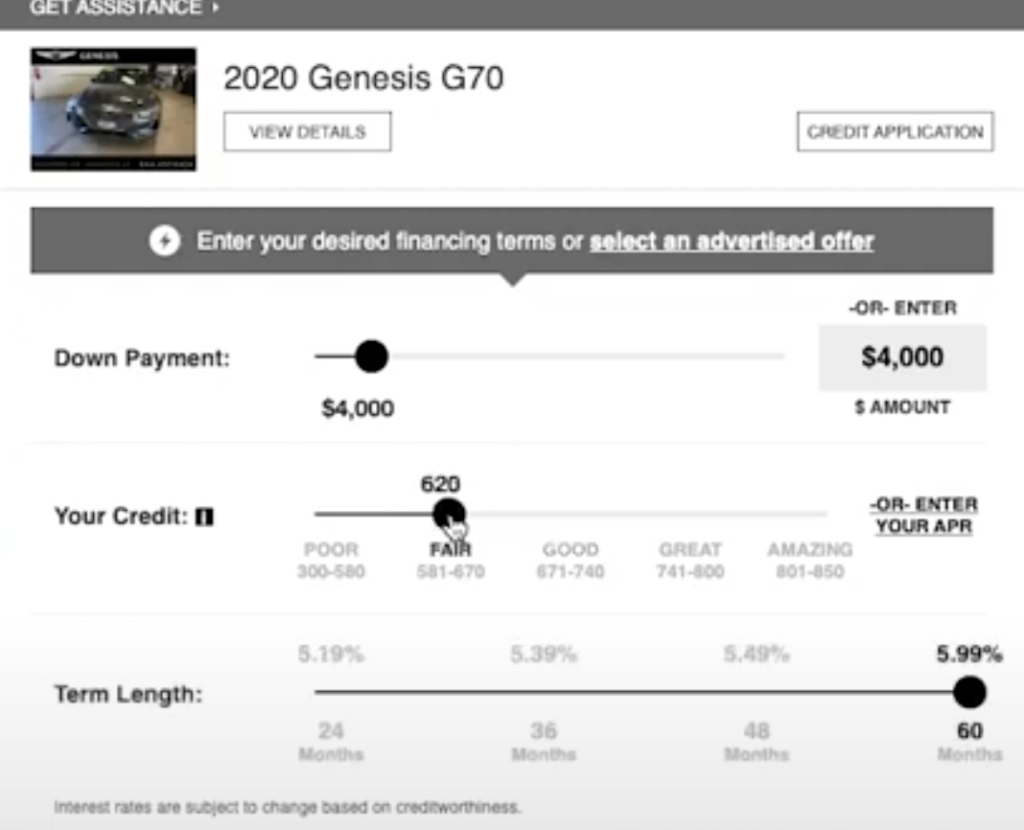

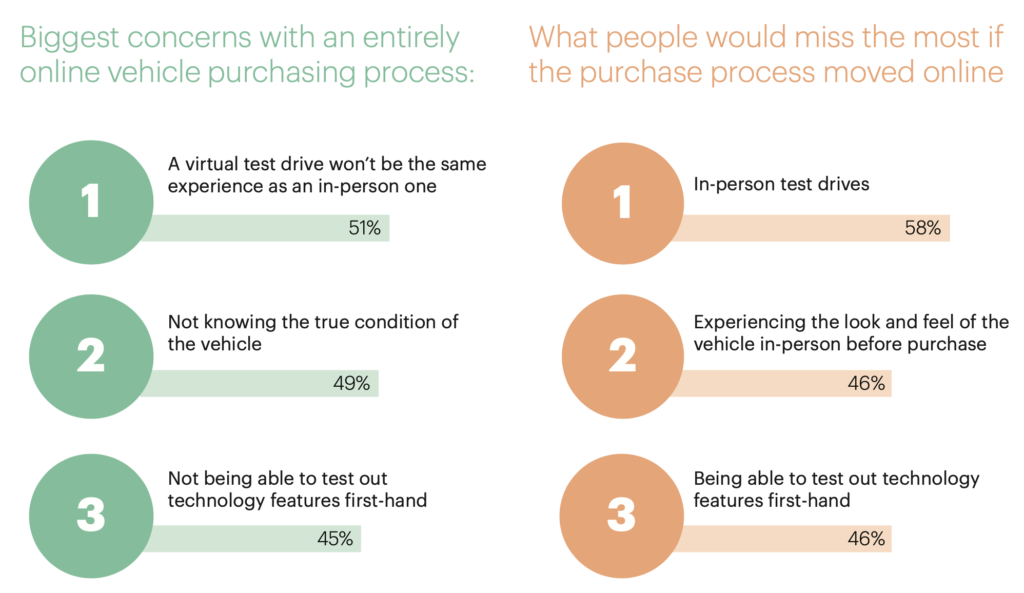

That trainer and his session came to mind during a recent conversation about digital retailing with Winston Harrell, a more than 30-year industry veteran who serves as one of DealerSocket’s Strategic Growth Managers. He believes digital retailing is a good additional step in the process and one that consistently delivers high-quality leads.

“What I like about digital retail, especially right now [during COVID-19], is it affords an opportunity for customers to have a better experience in their information-gathering phases,” he says.

However, Harrell wondered if we’re setting up today’s digital car buyers for failure by allowing them to think a credit score is all that’s involved in securing a finance approval. Sure, a credit score can help determine rate and term, but a credit score isn’t what finance sources use to determine the single greatest factor involved in an approval: Ability to pay.

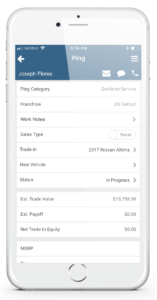

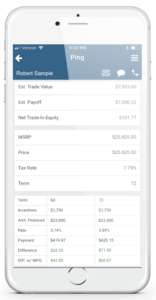

“That’s why I believe SocketCredit is a far more important tool right now,” he says. “It tells me right from the beginning where I’m going to be with that customer that just came through our PrecisePrice tool.”

Harrell’s point is that since today’s digital retail tools allow customers to work deals backward, dealers need the CRM to be able to do the same. In DealerSocket’s case, SocketCredit enables dealers to manage the credit application process within the CRM — from receipt of the online credit application and completion of the required compliance checks to submission for finance approval and receipt of the finance source’s decision.

So, no, this isn’t a plug for DealerSocket’s platform, because what Harrell observed is a crucial entry point for the showroom process — the hand-off, if you will. Here’s a scenario of how that might work:

Let’s say a customer engages your digital retail tool. She sets the sliders to her current credit score, desired down payment, and term length. Unsatisfied with the monthly payment, the customer enters an APR for which she thinks she qualifies. Satisfied, the customer submits her customized deal to the dealership.

Once the deal appears in the CRM, Harrell says the customer should be entered into a campaign that calls for a sales staffer to reach out immediately. Now, there are two questions Harrell says the salesperson needs to pose once connected: Where did you get your credit score? And where did you get the rate you plugged into the tool?

If the answer is, “My credit union,” the response should be, “Fantastic!” Next, the salesperson needs to ask if the customer completed a credit application with the credit union. If the rate and score were based on a simple phone call, here’s what you want to say:

“Great! A credit score does matter, but there’s so much more that comes into play. I work with 28 finance sources that may be able to do better than what you saw on PrecisePrice (managing expectations). Would you like me to review those for you? I’ll shoot you a text/email with a link authorizing a credit inquiry. Fill it out, and I can see which one of those programs works best for you. Is that OK?

Yep, with a few trial closes, you just might capture the most critical element to putting a car deal over the curb: the customer’s financing.

And here’s the beauty of Harrell’s scenario: All that data you collected on the customer — vehicles of interest, compliance checks, credit app, authorization to pull credit, and lender decisions — are accessible through the CRM.

That means the next time a regulator questions a Red Flag verification or a customer wants proof your dealership had authorization to pull credit, “you don’t have to go into multiple pieces of software to dig it up.”

Gregory Arroyo is the former editor of “F&I and Showroom” and “Auto Dealer Today” magazines. He now serves as senior manager of strategic content for DealerSocket. Email him at [email protected].

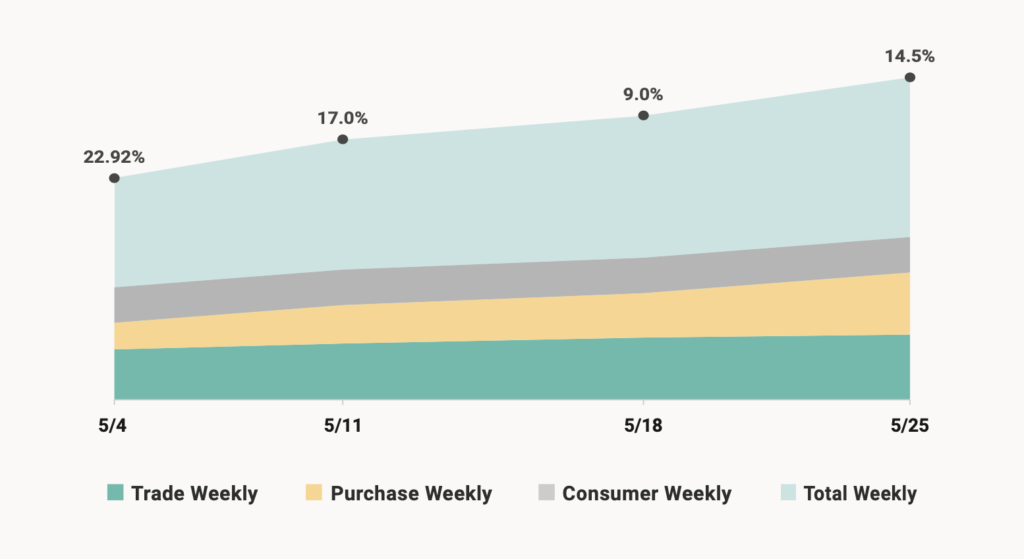

Data from DealerSocket’s Inventory+ team shows a 20% week- over-week decline in total appraisals the week of March 16, when most stay-at-home orders took effect. Trade appraisals, or appraisals that occur on a customer’s trade-in, were down 26% during the same period, while “Purchase Appraisals” on wholesale and auction units plunged by 35%, according to

Data from DealerSocket’s Inventory+ team shows a 20% week- over-week decline in total appraisals the week of March 16, when most stay-at-home orders took effect. Trade appraisals, or appraisals that occur on a customer’s trade-in, were down 26% during the same period, while “Purchase Appraisals” on wholesale and auction units plunged by 35%, according to