Dealer solutions and services on display at the Las Vegas Convention Center

Solera’s Vehicle Solutions business line, the leader in vehicle owner lifecycle management, is excited to present their latest dealer and OEM solutions updates at the NADA SHOW 2024 in Las Vegas from Feb. 1-4. This premier event offers automotive industry professionals an opportunity to explore groundbreaking technology and strategies for expanding their businesses. By revolutionizing and reinvigorating dealership operations, customer relationship management, marketing and digital advertising, and fixed operations, Solera’s dealer solution suite has the potential to change the game in the industry.

Visitors to the Vehicle Solutions’ interactive booth will have the opportunity to experience firsthand the game-changing technologies transforming the automotive industry. Here are a few of the exciting new products that Solera is presenting:

- RedCap Service Suite: This modular platform, designed for large-scale businesses, offers a comprehensive suite of solutions that integrates seamlessly with various dealership processes, including appointment scheduling, check-in procedures, lane walkarounds, electronic loaner management, digital payments, and other advanced features. This is set to revolutionize automotive fixed operations, boosting efficiency and profitability for dealerships nationwide.

- Peri by Solera: This innovative payment processing service is tailor-made for the automotive industry. It offers a sustainable approach that effectively lowers transaction fees for businesses of any size. Peri’s goal is to bring about a positive change in the merchant services sector, which is frequently burdened with hidden fees and complex terms and conditions. The most noteworthy feature of Peri is its potential to reduce transaction fees by up to 35% compared to industry standards.

- ServiceAgent AI powered by Stella: The state-of-the-art inbound call center solution will soon leverage artificial intelligence to provide an smart, efficient, and personalized call center experience that redefines customer engagement in the automotive industry.

- AutoMate and DealerFenix Partnership: Solera’s partnership with DealerFenix brings unprecedented efficiency to dealership operations by integrating DealerFenix’s expertise in digital retailing with AutoMate’s innovative dealership solutions. This collaboration aims to enhance the overall customer experience.

- Marketing Platform Enhancements: Solera’s commitment to excellence extends to its state-of-the-art marketing platform under the AutoPoint brand. On AutoPoint’s OnDemand platform, dealers can engage with potential customers in just a few minutes through targeted marketing campaigns using the new website visitor ID system.

“Solera’s Vehicle Solutions team is extremely proud to showcase our latest innovations, cementing our pledge to revolutionize the automotive sector,” declares Tony Graham, Executive Vice President. “Our pioneering solutions promise to redefine the terrain of dealership operations with a steadfast dedication to furnishing state-of-the-art solutions and services that not only fulfill but surpass the changing requirements of our clientele, while setting new standards for productivity, financial gains, and customer satisfaction. Join us for discussions, demos, and a glimpse into how our technology empowers dealerships to thrive in a dynamic market. We can’t wait to see you at NADA, where innovation meets inspiration!”

Attendees and media representatives are invited to visit Booth 2901W at the 2024 NADA Show to experience these groundbreaking services and solutions firsthand. Solera’s Vehicle Solutions team will be available for presentations, demonstrations, and discussions regarding their comprehensive suite of solutions.

To learn more about Solera’s Vehicle Solutions or to secure a spot while at the NADA Show, visit www.solera.com/nada.

The Significance of Regular Statement Reviews

Reviewing your merchant services statements for your automotive business plays a vital role in cost management, competitive edge maintenance, security and compliance assurance, and enhancing the overall customer experience. Periodic assessments empower you to make knowledgeable decisions that can significantly benefit your business.

Important Factors in Each Statement:

1. Expense Management: Understanding the various fees linked to your merchant services is crucial for efficient expense management. These charges encompass transaction fees, monthly expenditures, and other expenses. By carefully examining your merchant services, you can identify areas where potential excess payments may occur and take corrective actions.

2. Fee Adjustments: Keep a lookout for new fees or modifications in existing fee structures, as these can arise with numerous service providers. Regular evaluations ensure that you remain informed, averting unexpected financial surprises.

3. Competitive Pricing: Securing the most favorable rates can result in substantial savings for your business. Rates may fluctuate among providers, so periodic assessments enable you to gauge whether you are still receiving competitive pricing. A simple calculation—involving dividing total processing fees by the total processed volume—unveils the percentage representing your overall cost of accepting credit card payments.

Introducing the All-New Peri by Solera

Explore Peri by Solera, an innovative merchant services credit card payments platform for credit card payments crafted to offer competitive rates and cutting-edge security specifically tailored for automotive enterprises. While merchant services statements may appear initially intricate due to the variety of charges and fees linked to credit card processing, breaking them down into simpler steps can enhance their comprehensibility.

Mastering the Art of Statement Analysis

Here are a few ways to interpret a merchant services statement:

1. Account Details: Begin by identifying the statement date and ensuring that your business name, merchant identification, and contact details are accurate.

2. Transaction Overview: Take notice of the total sum processed, the quantity of transactions, and any instances of chargebacks or refunds.

3. Fee Summary: Pay close attention to the fee section, encompassing:

- Interchange fees: Fees established by credit card associations (Visa, Mastercard, etc.) passed on to your merchant account provider.

- Processing fees: Costs from your merchant account provider for processing transactions.

- Monthly fees: Any monthly service costs, such as statement or gateway fees.

- Other fees: These may involve fees related to chargebacks, PCI compliance, and other services or penalties.

4. Payment Deposits: Understand the amount of money deposited into your business bank account after accounting for processing charges and other deductions.

5. Chargebacks and Returns: Scrutinize any instances of chargebacks (disputed transactions) or refunds and how they were managed.

Optimize Your Potential Savings Today

Regularly assessing your statements is crucial in detecting disparities and optimizing your payment processing expenses. By comparing past statements, you can identify substantial changes in fees, transaction volumes, or chargebacks.

Peri by Solera is here to assist automotive businesses in saving money. Reach out to a Solera representative today to ensure you’re not missing out on potential savings. Contact us during business hours at 888-974-2952 or schedule a meeting.

Did you find this article helpful? Find more great content at dealersocket.com/blog and solera.com/blog.

Dealerships often face significant challenges when it comes to credit card payment processing. In the automotive industry, transactions can vary greatly in size, from minor sales to major purchases, leading to issues with processing fees. Some providers charge higher percentages for larger transactions, affecting the dealership’s profitability or necessitating higher costs for customers in a fiercely competitive market.

Understanding Dealers’ Payment Processing Challenges

Efficiency and reliability in payment processing are pivotal for dealerships. Delays or technical glitches can disrupt operations and impact customer satisfaction. If payment terminals and point-of-sale (POS) systems aren’t tailored to the specific needs of dealerships, it can result in costly disruptions and potential lost business opportunities.

Ten Common Pain Points in Dealership Payment Processing

Let’s explore ten common pain points that independent and franchise dealerships encounter with their payment processing services:

- High Processing Fees: Many merchant services providers impose substantial processing fees for credit card transactions, particularly on larger sales.

- Lengthy Settlement Times: Delayed settlement times can pose cash flow challenges, with providers taking days or even a week to deposit funds from credit card transactions.

- Equipment and Technology Issues: Reliable payment terminals and POS systems are pivotal for smooth transactions. Frequent malfunctions can disrupt business operations and negatively affect the customer experience.

- Lack of Industry-Specific Features: Some providers neglect to offer features tailored to dealerships’ needs, such as invoice management, flexible payment options, or seamless integration with existing management software.

- Inadequate Customer Support: Prompt and efficient customer support is essential for resolving payment-related issues quickly. Frustration arises when providers lack responsive support or fail to address concerns promptly.

- Security Concerns: Dealerships handle sensitive customer data. Inadequate security measures can expose them to data breaches and erode customer trust.

- Hidden Costs: Some providers may hide additional costs, such as monthly fees or PCI compliance charges, impacting the dealership’s bottom line.

- Limited Payment Options: A lack of diverse payment options can deter potential customers and restrict revenue streams.

- Compliance Challenges: Dealerships must adhere to industry regulations. Non-compliance can lead to legal issues and fines.

- Inefficient Reporting: Inadequate reporting tools make it challenging for dealerships to track and analyze payment data for business insights.

These challenges underscore the importance of selecting a provider that offers competitive rates, reliable technology, industry-specific features, robust security, and responsive customer support to address the distinct requirements of independent and franchise dealerships.

Meet Peri by Solera: Revolutionizing Payment Processing

Introducing Peri by Solera – a payment processing service designed to help dealerships reduce costs on every transaction. It enables businesses to swiftly adopt or enhance their payment options with lower fees, bolstering their competitiveness in today’s market.

With Peri, dealership owners gain access to reliable customer support, ensuring that any technical issues related to accepting payments online are promptly resolved. This guarantees no delays in getting paid by customers, providing peace of mind to dealership owners.

Discover how Peri merchant services can revolutionize your dealership’s payment processing experience, boost your competitiveness in the industry, and address these pain points head-on.

Learn more about Peri by Solera today.

Did you like this article? Find more great content at dealersocket.com/blog and solera.com/blog

Independent car dealerships must remain competitive compared to other independent dealers in their area and large national chains with big budgets, a strong brand identity, and access to a nationwide inventory. It can be tough out there, but many independent dealerships are not only competitive, but they thrive.

How do they do that? They pay attention to industry trends, understand what customers want, and actively work to stay competitive. Here are some ways they do just that.

Industry Trends in 2023

While the used car boom that sent prices sky high may be winding down, there is still a large demand for quality used vehicles. With the cost of new cars reaching new highs, interest rates rising, and supply chain woes still plaguing the industry, used cars still rate as an excellent choice for many consumers.

Once seemingly overvalued, older cars will take the biggest hit, while late-model cars will hold steady or decline slightly, mirroring the trend for new cars. While EVs are sparking more excitement, long wait lists for new vehicles are still growing, so the opportunity to sell used EVs is enormous.

What do customers want?

According to a survey conducted by the National Independent Automobile Dealers Association (NIADA), customers want many of the same things they have come to expect from independent dealerships: transparency, honesty, and fair pricing. But that’s not all.

They also prioritize quality vehicles, a wide selection of inventory, and knowledgeable salespeople who can help them find the right car for what they need and that fits within their budget.

Along with those things, customers value convenience and a positive buying experience, including easy financing options, reliable service and maintenance, and a welcoming atmosphere. Essentially, they want a positive and professional experience. How does this translate to what you do every day to stay competitive?

8 Tips to Stay Competitive

It’s great to know what industry trends are and what customers are looking for, but it is also essential to take action to stay competitive. Here are eight things you can do.

- Offer a wide variety of vehicles: Customers like choices, including new popular hybrids or EVs. But they also like a variety of prices, models, and years to choose from. Don’t be afraid to be creative or even niche down and specialize.

- Build a robust online presence: It’s a digital world, and many customers pre-shop online. Be sure to list your vehicles and have good, professional-looking photos.

- Provide excellent customer service: This includes your parts and service departments if you have them. Customers remember the image you portray everywhere, so be sure that customer service runs through your culture.

- Focus on quality: Ensure that your dealership’s vehicles meet high-quality standards by only offering vehicles with clean histories accompanied by thorough inspections.

- Offer financing options: Just like a variety of cars, customers like a variety of financing options. Be sure to offer choices for those with everything from excellent to below-average credit. The more choices your customer has, the better.

- Embrace technology: Car dealerships can use technology to their advantage with advanced dealer management software like IDMS, which is built specifically for independent and BHPH dealers to help them increase revenue, better manage inventory, improve sales processes, and maximize productivity.

- Offer unique services: Find what sets your dealership apart from others in your area by offering specialized services and options. For instance, LoJack Go from GoldStar gives dealers connected vehicle technology for consumers by offering easy digital payment options, which minimizes delinquencies and increases dealer collections. Choose a niche where you can focus your attention and open different departments to better serve your customers.

- Attend local events: Attend local events and trade shows, hold or be a part of offsite sales, sponsor local non-profits and events, and more.

While it can seem like there is a lot of competition at times, this fact helps you focus on ways to improve your dealership, which benefits you and your customers in the long run. This relates to everything from your sales team to your parts department and service desk.

To learn more about the competitive advantages offered by Solera, visit www.dealersocket.com.

Solera solutions help dealerships out sell, out service, and out perform the competition

Every year, the annual National Automobile Dealers Association (NADA) show attracts thousands of auto dealership employees. They look to network, learn emerging industry trends, and find out about the latest technology that can help them streamline operations and improve improve CX (customer experience).

And we will be there too! We are exhibiting at the Kay Bailey Hutchinson Convention Center from Jan. 26-29th. There we will demonstrate our industry-leading solutions that help dealerships drive sales, reach more customers, and improve profit margins.

Solutions Built for Dealers

Whether it’s marketing and sales, financing and titling, or service and repair, our solutions help:

- Optimize every marketing dollar: Our best-in-class omnichannel marketing platform and CRM help dealers optimize investments across traditional and digital channels. They also support both sales and service business objectives. And new integrations give dealerships additional outbound marketing channels to better reach customers.

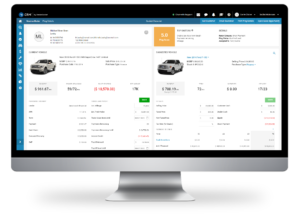

- Connect with customers: The DealerSocket CRM is a comprehensive customer management solution that converts and retains customers through the sales and service lifecycle while increasing revenue per transaction. The industry-leading CRM doesn’t only drive sales, but also connects all systems, simplifying and enriching the experience for both your team and customers.

- Maximize customer pay spend: MultiPoint Inspection is your total shop efficiency solution. It enables your team to optimize processes, link workflows across all fixed operations functions, and eliminate wasted time by enabling real-time communications visibility into operations.

- Stay on top of inventory: Inventory+ keeps inventory fresh by optimizing your vehicle mix, buying and selling vehicles at the right price, and trading with sister stores to stay aligned with sales trends at your dealership. Inventory+ also provides car dealers data based on real-time insights to help them make faster, better decisions.

- Boost profits: The combination of Inventory+ and CRM helps maximize your business outcomes and optimize your processes. You can then better identify efficiencies and manage inventory and incentive investments.

- Elevate dealer websites: Now infused with DealerSocket’s data platform, DealerFire sites delivers fast, sleek websites that are easy to build with no coding required. Powered by Engine6, these websites are fully responsive and are built to perform seamlessly on mobile devices. Thereby, driving more traffic, more leads, and more sales.

Why Meet with Us at NADA 2023

First and foremost, our dealership solutions streamline operations and workflows. But they also provide actionable insights, improve CX, and keep customers engaged with their dealerships. To find out more about how these solutions can accelerate your dealership’s success, visit our NADA page.

When you have access to an all-in-one solution, it minimizes the time and resources needed to get the job done. That’s what dealer management software can do for you. It brings together all functions of inventory management into one simple platform. Why wouldn’t you employ it if it makes your job–and that of your teams–easier?

What Is Dealer Management Software?

Back to the basics: dealer management software is one easy-to-use system with a full suite of products and plugins. It helps integrate and manage sales, parts, service, finance, insurance, and warehouse inventory, creating a more efficient use of resources from staffing to features and services.

How It Benefits Your Dealership Teams

As a saavy DMS user, you likely think you know all the many ways DMS can help, but some may not be readily apparent. Here are nine points to share with your employees and other stakeholders:

- It can identify trends and forecast market needs for parts across organizations or dealer and franchise teams.

- Because it’s cloud-based, it can be accessed and utilized anywhere.

- It also offers savings opportunities because it can lower costs by creating new efficiencies.

- It can identify where available stock or parts are located.

- It helps prevent over-purchasing.

- It helps with local sourcing and needs.

- One of the most efficient uses is offering a full suite of systems that integrates across franchises or dealers.

- Team members can share data and insights.

- And all of this contributes to higher customer satisfaction rates, creating loyal brand advocates.

Why Your Dealership Needs a Powerful DMS

Now that you know the many other ways dealer management software can help, let’s look at why you need it:

- OEMs/Dealers can use the system to forecast needs across systems, offering the opportunity to save money. Since accurate inventory helps to identify needs when discounts are available for stock or parts, dealers can also get refunds on those parts that go unused.

- DMS also centralizes information. It keeps customer data and interactions in one place and helps with local flexibility, locating parts or services across franchises or dealerships.

- It also improves productivity by saving time and sharing accurate data across teams.

- Finally, it gives you access to seamless reporting by offering up-to-the-minute data and insights, which helps with sales growth.

How to Get Started

Dealer management software is the all-in-one solution for your team’s needs, so now is the time to transform. Solera offers enterprise-level solutions, including our innovative DMS and IDMS.

Learn More About Our Best-In-Class DMS & IDMS Solutions

The customer experience (CX) is the driving force of any successful business. More than ever, providing customers with seamless service and access to information is vital to attracting and retaining valuable consumers. For that reason, franchise and independent dealership websites must focus on the customer experience by reflecting this cultural shift and offering auto buyers a variety of ways to find the information they seek.

Customer Experience is King

According to recent data from Qualtrix, 8 out of 10 people feel customer experience should be improved across products, prices and fees, customer service, and ease of use. Brands risk losing9.5% of their revenue on average due to poor customer experience. And more than 50%of customers say they are likely to leave a brand after a bad customer experience.

How Dealer Website CX Helps Customers

You will lose potential and existing customers if your website is clunky, outdated, or hard to navigate. People have many choices, so optimizing your website experience, for both the car buyer and service client, is key to generating new revenue and word-of-mouth recommendations.

Here’s what to look for:

Make Website Easy to Use

The first –and most important– element of a successful dealer website is that it’s responsive, meaning it works the same on any device. Most consumers initially research purchases from smartphones, so your branding must be consistent across platforms. Ensure it’s easy to search, provide chat options and use eye-catching elements that are visually exciting. You are selling your products and services here, and this is your first chance to make an impression before a client ever steps through your doors.

Offer a Variety of Resources

Giving your customers many ways to learn about your products and automotive services on their own can only benefit you. A rich and compelling content offering will allow potential and current customers to explore and find answers to their questions on their own before they meet with you in person. Giving them the information they are looking for helps establish you as a valuable resource, even if they don’t buy anything this time. You can offer this by creating an extensive knowledgebase on your dealership website with testimonials, product videos, and articles on trends or new releases. Customers will check your social media for reviews, so stay on top of those channels. And offering a “Get a Quote”/”Build Your Vehicle” page allows the consumer to envision how the vehicle will work with their lifestyle.

Drill Down on Data & Information

Offering a vibrant car search inventory is another way to elevate the customer experience. Consumers like to do their research, so provide different ways to imagine themselves in one of your vehicles. Here are a few suggestions:

- Create a “Lifestyles” page, sharing options for commuters, families, outdoor enthusiasts, and eco-friendly options.

- Pricing/financing calculators are popular features

- Share stats/trends on your vehicles

- Highlight current offers

- Repeat calls-to-action throughout the pages on your site

- Add contact forms to each page to capture user information

Take Advantage of Insights to Improve the Customer Experience

Finally, identify the most utilized features customers visit and mine them for data and insights. And don’t fall back on updates. Continue to innovate and improve your site based on what you see customers engaging with and visiting the most. Crafting a rich and engaging dealer website will elevate your customer experience and set you apart from your competition. Find out more about how to create a new or optimize your current independent or franchise website today!

Learn More About Our Best-in-Class Solutions

CRM: Critical Dealer Tool

Why is CRM not included in the digital retailing discussion?

While there is plenty of attention on digital retailing during the pandemic, there has been little attention paid to how CRM help dealers navigate this period of social distancing. But it’s understandable. The CRM isn’t the new shiny object like digital retailing, and COVID-19 certainly reignited the digital-retail discussion. However, there’s no doubt of the importance of appointment-setting during COVID-19, especially for dealerships located in markets where sales were limited to appointment-only. It’s an art that predates the CRM, but, thanks to that important front-end tool, appointment-setting has become a science for some operations.

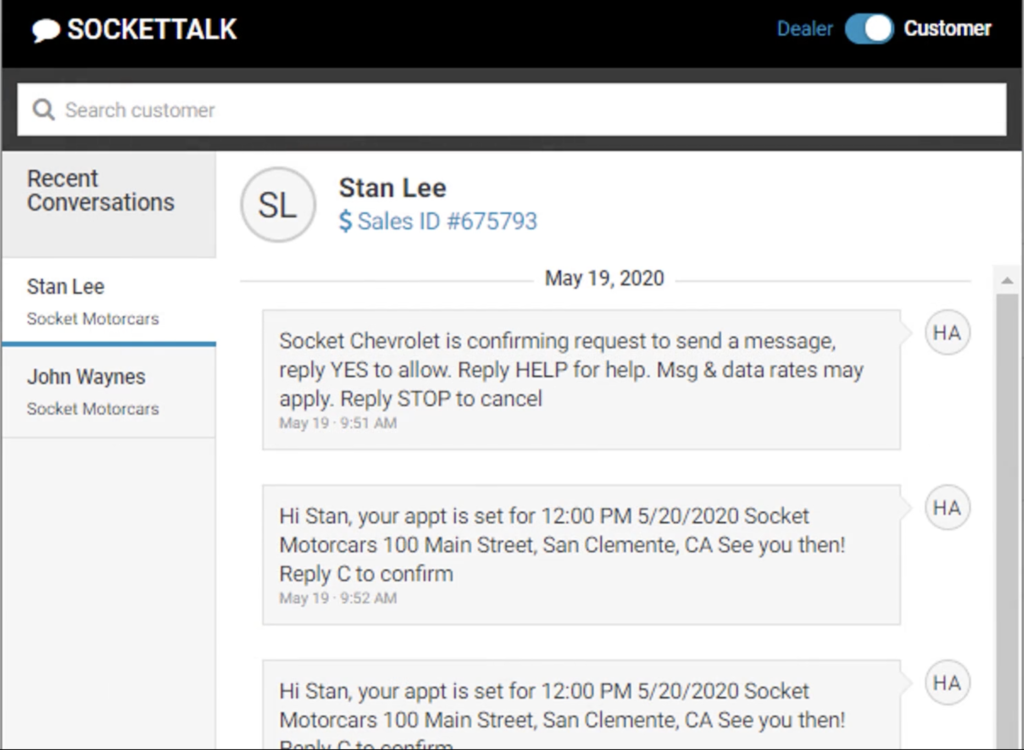

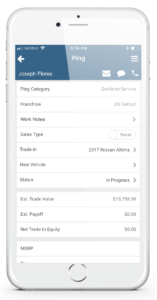

What often gets overlooked is just how often CRM providers update this critical tool. In DealerSocket’s case, the cadence is every two weeks. And the focus of late for DealerSocket is appointment-setting, with texting now a key component, thanks to dealer feedback.

Auto Buyers Prefer Texting

Recently, a California dealership customer began sending every internet lead received an initial opt-in text. If there was no response within a few minutes, the following text message — one that garners a response 70% of the time — was sent, “We just received your internet request, and we have a few questions. Do you prefer a call or a text?”

That dealership sent and delivered 26,617 texts.

Then there’s Rashad Tillman, who manages a centralized BDC for a two-rooftop independent group in Southern California. With a keep-it-simple approach, he operates under the belief that a successful road to the sale requires five yeses from a customer. The use of DealerSocket’s SocketTalk texting tool usually accounts for two of those yeses, starting with the opt-in text.

“All we’re looking for is a reply. Once we get one, we’re in control,” Tillman says. And once a customer opts in, the following text is sent, “’We received your lead for the [make and model], which we have available. Do you have time today to test-drive the vehicle?’”

“That usually results in a reply,” Tillman says. “I’ve been working with DealerSocket’s CRM for seven years now, and I figured out real early that texting is now the primary form of communication. So, we try to eliminate as much conversation as possible.”

In one month, Tillman’s 20-member team sent and received 59,402 text messages through the CRM’s SocketTalk texting tool, with two members logging 2,900 sent and received texts for the month. Tillman notes that texting accounts for 80% of his department’s activity when working a lead, which is he says knowing how to configure DealerSocket’s CRM dashboard correctly is critical to making sure no opportunity falls through the cracks.

Better Manage Leads and Opportunities

With DealerSocket’s CRM, managers don’t have to dig into the solution’s reporting tools to keep tabs on their team’s lead-handling activities. Merely creating a dashboard widget for web leads allows managers like Tillman to keep tabs on every opportunity and every text or email exchange. That’s where he says most managers go wrong. They have the talent and skills, but they resist to allow technology to augment their abilities.

In fact, the use of technology is how managers like Tillman are keeping their dealerships in the game when today’s car buyers are shopping more brands, more vehicles, and more dealerships than those car-buyer studies predicted they would four to five years ago. The latest data on that front comes from a study commissioned by Urban Science, which showed that the average car shopper is considering 2.6 brands, visits 2.5 dealerships, and submits, on average, three lead forms.

Regardless of whether your BDC staffers or sales teams are selling appointments or demonstrating to customers a willingness to be shopped to win their business, converting a lead into an appointment requires a CRM-driven process that doesn’t end once the customer says, “yes.”

The best part of a CRM-driven appointment-setting process is that it can be automated every step of the way. In the case of DealerSocket, our CRM’s Campaign Manager allows you to assign your operation’s best word-tracks to a BDC staffer’s scheduled response to an inquiry. It can also automate appointment reminders, confirmation communications, and follow-ups. Then there’s the CRM’s Business Rules automation tool. This allows managers to initiate activities such as vehicle prep and enrollment of customers into appropriate campaigns.

With this, CRM should be included in the digital retailing discussion. When a customer structures a deal through your website’s digital retail tool and submits their information, the question dealers need to answer is, “what does the experience look like when it does?”

Data-mining expert digs into six popular data-mining lists and offers a few considerations on how to optimize them for success.

By Winston Harrell, Strategic Growth Manager

There is no right way to data mine; the only wrong thing you can do is let all those sales prospects sit untouched in your CRM. Because on any given day, someone in your customer database is thinking about purchasing a new car. The key is not to be afraid to experiment, especially when it comes to the search parameters you use to ID those in-market opportunities.

That holds true when using a data mining tool does the searching automatically. Your store’s average credit score, time of ownership, and annual driving miles can make all the difference. And as we all know, being the first to engage means higher margins. Best of all, you don’t have to pay a lead provider to deliver the business you already earned. Let’s dig into six prospect list you can optimize by simply doing a little homework.

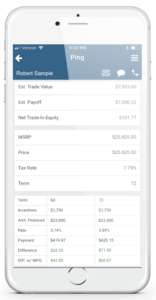

List No. 1: Customers Who Can Lower Their APR While Trading Up

Interest rates are historically low, which means there are opportunities to help past buyers take advantage. Typically, these will be customers with an APR above a certain range. Getting them back into your showroom could mean a new or newer vehicle and potentially saving them thousands of dollars in interest.

Search parameters for this list include average credit score, loan term, and down payment. Specifics vary depending on location. For example, in an area with an average credit score of 650 or less, use 2.5 years or greater as a timeframe of ownership. The reason is that’s the amount of time it takes for consistent payments to improve a credit score.

In fact, it’s a good idea, especially during these uncertain times, to conduct a regular credit bureau analysis. What you need is a credit tier profile of your customers. This knowledge cannot only be used for prospecting, it can guide your inventory sourcing strategy when finance sources tighten up.

List No. 2: Customers Who Can Lower Their Payment While Trading Up

Equity isn’t the only way to help a customer lower their payment while trading out to a new car. Your OEM’s current incentives, as many new car owners discovered through the pandemic in 2020, can also help lower payments. For example, it may be possible to identify car owners who are in a less equitable position but who are eligible for a large rebate, which can help offset their lack of equity.

To identify this list, follow the guidelines of the book your dealership uses to estimate current equity, then adjust according to incentives offered. For example, Kelley Blue Book wholesale plus $500, or NADA average trade-in minus $500.

Some data mining solutions will automatically match a prospect’s current vehicle with a vehicle in your inventory that’s similar to the one they already own. That makes it easy to send emails containing your lower payment offer and a link a vehicle details page highlighting the current model-year version of their vehicle.

List No. 3: Customers Who Declined High-Cost Service Repairs

When customers decline recommended services, it might be an indicator that the repair bill was more than the person was willing to invest. That means there’s a good chance they are weighing their options: Pay $3,000 for that repair or just buy a new car? So, set your data mining tool or search for customers who declined repair estimates above $1,500 and $3,000. Success will depend on brand and location, so do some experimenting.

List No. 4: Customers Approaching End of Lease

What makes identifying end-of-lease customers a popular activity is there’s a deadline for them to make a decision and we know the date. So, it’s a far easier process to set up that campaign than one that centers on equity position. The key is to engage these customers six months out and increase the frequency of communications at the deadline approaches.

When building your lists or setting your data mining tool’s parameters, you may want to target a specific model your used car manage wants to add to inventory. You can also search by specific ZIP code, area code, distance to the dealership, or even finance source. Based on the lease criteria, for instance, certain finance sources may come out with lease pull-ahead program that targets Ford F150s.

List No. 5: Customers Approaching End of Finance Term

As customers approach the end of their finance terms, they may be open to considering a new vehicle. Parameters on what the right timeframe is can be a bit tricky. Location and clientele are major considerations. For example, if the majority of your finance deals are for six years, it might be worth contacting some of your customers as soon as three years into the loan.

Customers who drive 12,000-plus miles per year will be open to trading their car at a higher frequency rate than those who drive only 8,000 miles per year. Other parameters to experiment with include equity position and payments.

The key with this list is to find owners who are past the honeymoon phase of ownership. Similar to the seven-year itch in a marriage, there is a period where most car owners don’t hate their vehicles but would be willing to trade up if presented with the option.

List No. 6: Customers in an Equity Position on Their Current Vehicle

If you’ve ever data mined, you are familiar with this list. It doesn’t matter when a customer purchased their vehicle. If they have a certain amount of equity, it can be traded in for a newer vehicle. During periods like the one we’re in today, this list can be especially helpful to your used car manager.

In addition to identifying equity positions, I recommend slanting search parameters toward what the used car manager’s needs are. Specify makes, models, mileage, and other criteria that you want in used inventory. Once you pull these lists from your CRM, enroll prospects into campaigns that utilize email, text, and phone calls from your BDC or sales team.

While not as “hot” as new lead submissions, these lists should yield many potential car buyers. Plus, it’s a great way to check in with your customers. To make the effort worthwhile, ensure that your salespeople or BDC agents know how to qualify prospects. If someone isn’t interested, close them out and move on.

As previously mentioned, there’s no wrong way to mine your customer database, but a little homework and some experimenting will go a long way toward a fruitful data-mining expedition. But you better have a good process that’s written down, implemented, and managed.

# # #

We continue to think about all of you, our customers and partners, during this difficult time. This pandemic has caused deep challenges across our industry and for all of us, and I hope you know that DealerSocket continues to be here for our dealers. Our goal has been to strike the right balance between being prepared for our dealers and the market when our industry recovers and offering discounts to help our dealers as much as possible during this difficult time.

We will get through this, and we will get through this together. We are committed to fighting through this with you. We are beginning to see the first signs of positive trends as we climb out of the depths of the COVID-19 pandemic, and this has us all hopeful for the future.

In April, we heavily discounted our software for our dealers. In addition to our discounts in April, we have decided to offer the following DealerSocket billing reductions for May for all of our dealers:

- 25% off DealerSocket CRM

- 25% off RevenueRadar, our data and equity mining tool (see note below)

- 50% off Car Wars

- 25% off Inventory+

- 25% off DealerFire websites and PrecisePrice digital retail (see note below)

- 15% off IDMS

- 15% off Auto/Mate DMS

We have already sent out our May invoices, so next week you will receive a credit memo for the above discounts. With that said, similar to our discount package last month, there are some basic qualifying terms listed below.

In addition to these discounts in April and May, DealerSocket continues to offer our customers several promotions and free months of certain software products to help you navigate this crisis. Our offers include promotions for:

- Precise Price digital retailing

- Inventory+ Absolute Sourcing and New Car functionality

- Delivery Test Drive Scheduler

- Digital Credit Application

- Auto/Mate Remote eDeal

Since we are adding promotions and various resources for dealers often, please view DealerSocket’s latest information by clicking here, and, as always, please feel free to reach out to your Customer Success Manager with any questions or if we can help in any way:

If you are not yet an Auto/Mate DMS customer, I hope you know that we can reduce your DMS bill significantly during these challenging times as well as into the future by switching to Auto/Mate DMS. We have several bundled packages that include our Auto/Mate DMS product combined with other DealerSocket products to support you.

Thank you for partnering with DealerSocket. I hope you know how much we value and appreciate your loyalty, partnership, and your business.

I wish you, your families, and your team members health in these unprecedented times.

Sejal Pietrzak

CEO and President

DealerSocket

[email protected]

Details regarding our COVID-19 relief package:

- The fee reductions above represent discounts to the monthly subscription amounts by DealerSocket and not third-party products and fees such as DMS integration fees, books fees, and other transactional fees.The discounts above apply to customers that are current with their DealerSocket account.

- Note: OEM programs for websites, equity mining, and digital retailing offerings will be subject to working through OEM partners.

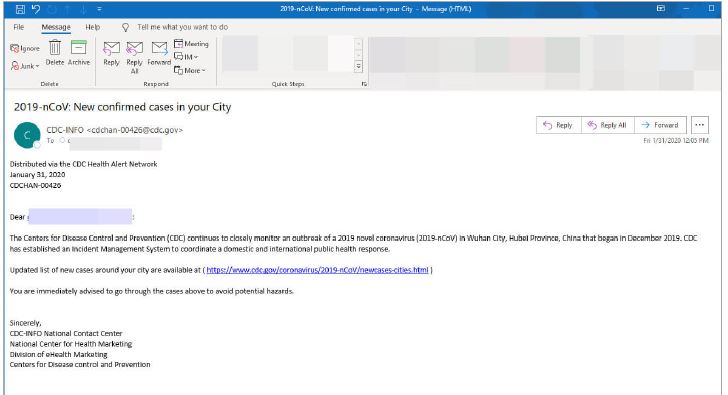

With threat actors working overtime, DealerSocket’s head of information security offers three tips to keep your dealership’s and your customers’ data protected.

By Gregory Arroyo

Greg Tatum has a warning for dealerships everywhere: Cyber threat actors are working overtime. Noting a definite uptick in suspicious activity since COVID-19 hit Europe in late February, he adds:

“Threat actors are actively searching for new targets through a number of different mediums. Things like social media platforms are a very popular target for information gathering that can be used in an attack.”

Tatum serves as DealerSocket’s head of information security. He joined DealerSocket nearly four years ago from a security services firm that works with companies in much more sensitive environments than automotive. I’m talking about healthcare and government contractors, sectors that see billions of attacks each year. So, yeah, we have the right guy on the job.

“DealerSocket spends a considerable amount of effort protecting our customers’ data,” he notes. “It’s part of what we do just to make sure our customers’ customers’ data is protected.”

Tatum isn’t the only one sounding the alarm. The FBI issued its own warning on March 20, noting that scammers are leveraging the COVID-19 pandemic to steal money, personal information, or both.

Just last week, the National Automobile Dealers Association reported that attackers are now putting up COVID-19-related websites that prompt visitors to download an application to receive COVID-19 updates. But you don’t need to download the app, as the site installs a malicious binary file as you contemplate whether you should.

The attack method uses AZORult, software that originated in Russia approximately four years ago to steal data and infect the breached computer with malware.

Tatum also alerted me to a new phishing campaign that pretends to be from a local hospital notifying recipients that they have been exposed to the Coronavirus and they need to be tested.

But it’s not just phishing and ransomware attacks. Business email compromise, or BEC, is also on the rise. That’s when a cyberthief breaks into a legitimate corporate email account and impersonates an employee to get the business, its partners, or other employees to send money or sensitive data to the attacker.

“In this climate we live in today, this is part of business,” Tatum says. “This is part of what we have to deal with as consumers of technology.”

Tatum, by the way, is available to help. He advises DealerSocket customers to contact their Customer Success Managers to get connected. In the meantime, he offers the following four tips to safeguard your organization and your customers’ data:

1. Stay Committed to General Security Awareness

The following is general security etiquette your teams should employ:

- Use strong, unique passwords for every account.

- Update software and enable automatic updates where available

- Think before you click

- Remain skeptical of all requests for sensitive information

- Use a VPN connection whenever possible to ensure secure data transmissions

- Shred or destroy confidential documents before discarding

2. Separate Work and Personal Data

Use company-issued computers and mobile devices for work purposes only. If you don’t have a company-issued device, be sure to check your company’s policies about using personal devices to access your organization’s data or networks.

Additionally, consider creating separate user accounts. Never use your work email for personal reasons or vice-versa. This segregation helps the company maintain the confidentiality of the data it collects and helps you maintain your privacy.

3. Secure Your Home Network

Update your router’s username and password immediately and use a strong, unique password. And never use the same password for your network and your router. Note that most routers ship with default login credentials that are public knowledge.

4. Don’t Forget About Physical Security

The comfort of your own home is no reason to forget about physical security. Simple acts like keeping doors locked and not leaving mobile devices unattended in a vehicle are non-technical ways to improve security.

Gregory Arroyo is the former editor of “F&I and Showroom” and “Auto Dealer Today” magazines. He now serves as senior manager of strategic content for DealerSocket. Email him at [email protected].